It never fails: a month ago, after showing CAT’s abysmal global retail sales, just three days later the company announced a historic business restructuring in which in addition to slashing its guidance, and confirming the China slowdown is now a recession if only in the manufacturing sector so far, it also announced it would fire 10,000, sending its stock crashing.

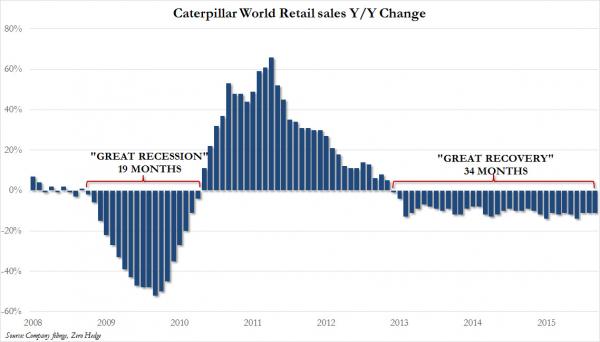

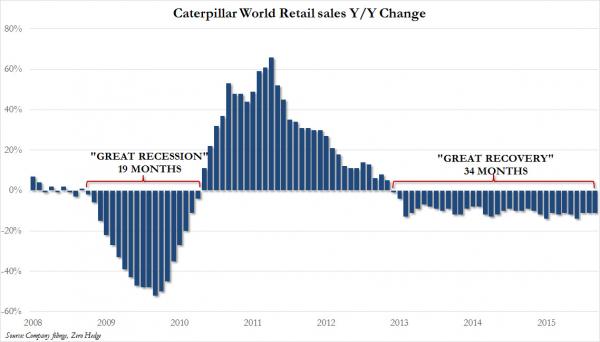

Then, yesterday, ahead of today’s earnings we again showed that when it comes to global demand for CAT products, there is simply no demand, and this particular dead cat refuses to bounce, with 34 consecutive months of declining revenues as well as 11 consecutive months of doubler digit sales declines.

We hoped this data would soften the blow from today’s CAT Q3 earnings which were clearly going to be ugly, and surely worse than consensus estimates.

Moments ago we got said earnings and as expected, they were indeed far worse than expected, with CAT reporting adjusted EPS of $0.75 ($0.62 GAAP), below consensus estimate of $0.77, while revenue of $11.0 billion also missed expectations of $11.33.This takes place even as CAT repurchased $1.5 billion in stock in Q3, or about 75% of the total $2.0 billion in buybacks it conducted in all of 2015 (compared to $8 billion in the past three years).

And the punchline: the company cut its 2015 EPS outlook from $5.00 to $4.60, even as it still keeps its full year revenue guidance at $48 billion adding that 2016 sales/rev is about 5% lower than 2015. It now sees 2016 revenues down 5% from 2015.

Some more highlights:

From the report:

“The environment remains extremely challenging for most of the key industries we serve, with sales and revenues down 19 percent from the third quarter last year. Improving how we operate is our focus amidst the continued weakness in mining and oil and gas. We’re tackling costs, and our year-to-date decremental profit pull through has been better than our target. We’re also focusing on our global market position, and it continues to improve even in challenging end markets. Our product quality is in great shape, and our safety record is among the best of any industrial company today,” said Caterpillar Chairman and Chief Executive Officer Doug Oberhelman.

“Our strong balance sheet is important in these difficult times. Our ME&T debt-to-capital ratio is near the middle of our target range at 37.4 percent; we have about $6 billion of cash, and our captive finance company is healthy and strong. We’ve repurchased close to $2 billion of stock in 2015 and more than $8 billion over the past three years. In addition, the dividend, which is a priority for our use of cash, has increased 83 percent since 2009,” added Oberhelman.

Leave A Comment