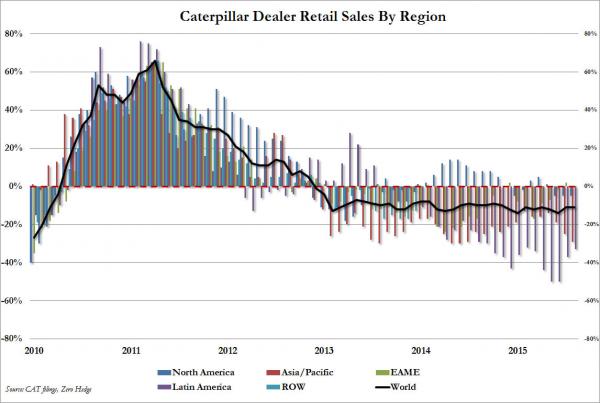

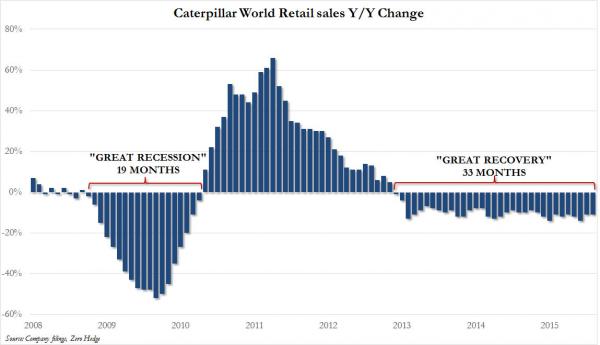

Just three days ago after looking at the latest CAT retail sales, we asked in stunned amazement “What On Earth Is Going On With Caterpillar Sales?” and showed the following two charts:

We now know the answer. The company was merely preparing to shock its investors with a $1.5 billion cost-cutting announcement, which includes the firing of as much as 10,000 people through 2018. Far worse, however, is the company finally admitting that it can no longer pretend reality does not exist, and cut its revenue outlook by 5% with the admission that “2016 would mark the first time in Caterpillar’s 90-year history that sales and revenues have decreased four years in a row.”

Of course, our readers already knew that.

From the ironically titled “Building for a Stronger Future” press release:

“Caterpillar Inc. (CAT) today announced significant restructuring and cost reduction actions that are expected to lower operating costs by about $1.5 billion annually once fully implemented. The cost reduction steps will begin in late 2015 and reflect recent, current and expected market conditions. For 2015, the company’s sales and revenues outlook has weakened, with 2015 sales and revenues now expected to be about $48 billion, or $1 billion lower than the previous outlook of about $49 billion. For 2016, sales and revenues are expected to be about 5 percent below 2015.

Key steps planned by the company include:

“We are facing a convergence of challenging marketplace conditions in key regions and industry sectors – namely in mining and energy,” said Doug Oberhelman, Caterpillar Chairman and CEO. “While we’ve already made substantial adjustments as these market conditions have emerged, we are taking even more decisive actions now. We don’t make these decisions lightly, but I’m confident these additional steps will better position Caterpillar to deliver solid results when demand improves.”

Leave A Comment