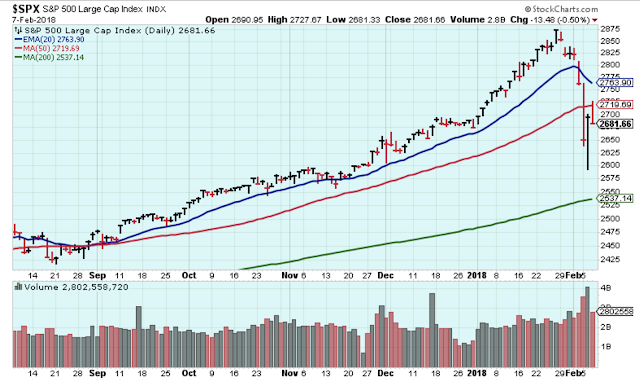

New 52-week lows dropped down to harmless levels which means that the selling pressure has been reduced. Now I think we have to wait a bit and let the market retest its recent highs and lows between 2600 and 2750 or so.

After such a severe sell off, the market needs time to shake off the shock before moving higher again. Another possibility… the market may struggle for awhile before starting another short-term leg lower in order to really shake out the over-confidence.

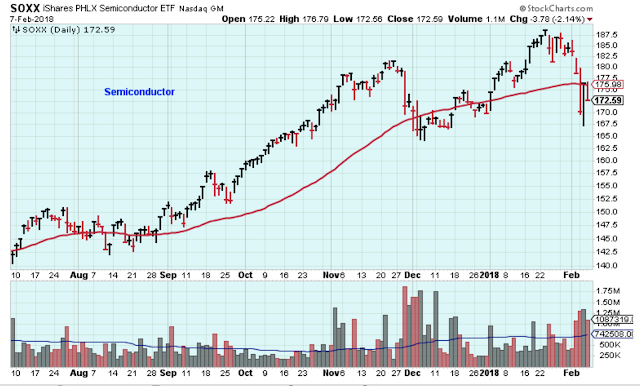

The semiconductor ETF is trading under its 50-day. I wouldn’t expect much from the general market until this group has a chance to consolidate and then start to move higher again. Without leadership from this group of stocks, I would question the ability of the general market to advance significantly.

I am not too worried about the short-term, but I am beginning to question the health of the market longer-term.

There is so much talk about inflation, but gold has not been confirming inflation. Two weeks ago this chart looked like it was going to break out higher. Now, it looks more like it has failed and is headed lower again.

The pieces of the puzzle aren’t fitting together correctly. There is something else going on. Copper looks like it might break down and head lower.

Bond prices continue to be weak (bond yields higher, bond prices lower). Have we reached the point where there is just so much debt that there aren’t enough buyers?

Bottom line: Caution and defensive strategies.

Outlook Summary:

Higher rates and the return of volatility are now headwinds for US stocks. I will continue to be defensive.

The long-term outlook is positive, but caution regarding rates and volatility.

The medium-term trend is down.

The short-term trend is down. Watching for the next short-term uptrend.

Leave A Comment