First came Bitcoin futures. Now it’s Ethereum’s turn.

Cboe Global Markets, the exchange behind the first market for Bitcoin futures, has telling market makers it is close to rolling out futures for Ether, the second-largest cryptocurrency by market capitalization, and may launch the product by the end of 2018, Business Insider reports citing people familiar with the situation.

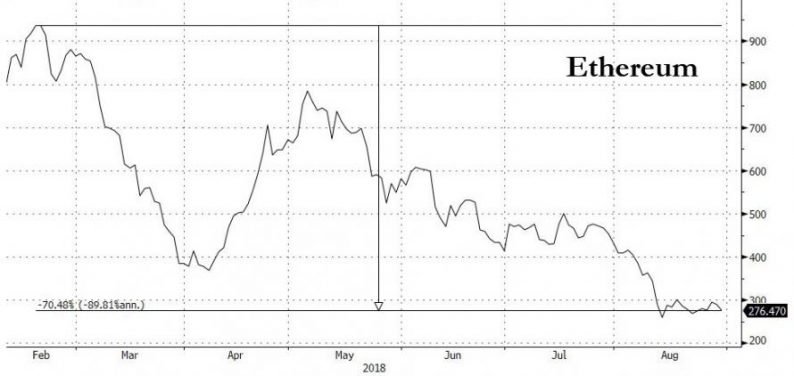

Despite expectations that Bitcoin futures, which were launched last December, would propel the cryptocurrency even higher, trading in Bitcoin future markets, which are hosted by the Cboe and CME in the US, has been relatively muted since their launch in December and, more ominously, marked the peak of the cryptocurrency which has seen a dramatic collapse ever since.

Nonetheless, the launch of Ether futures would “mark a significant step in Ether’s maturation as it could open the door to wider trading in the crypto and possibly an ETF.”

Cboe will be basing its futures on Gemini’s underlying market, people familiar with the situation said. Cboe also based its Bitcoin futures on the New York-based crypto exchange run by the Winklevoss twins. The futures and options exchange is waiting on the Commodities Futures Trading Commission to get comfortable with the product before its official launch, a person with knowledge of the matter said.

Despite Ether getting special treatment by the SEC, which said in June that the agency didn’t view the trading of Ether as violating securities law which could bode well for Cboe, the price of the cryptocurrency has plunged this year, and was trading at $276 most recently, an 80% drop from its all-time highs.

The Cboe had previously hinted that the Ether future may be coming, most notably in December 2017, when its president Chris Concannon said that a family of cryptocurrency products, including futures for Ether and Bitcoin cash, could come to fruition as the market continues to mature.

Leave A Comment