Charles Ponzi must be turning in his grave! His pyramid scheme in 1920 guaranteed returns of 50% in 50 days and 100% in 100 days. And initial investors clearly achieved these returns but most of them were too greedy to cash in. His total scheme “only” lost $20 million ($225 million in today’s money) for the investors. In comparison, Madoff cost his investors $18 billion. At least Ponzi became famous for his achievement. So far Madoff has not achieved fame.

But both Ponzi and Madoff were small time crooks compared to governments and central banks today. Because whether we take, Japan, China, the EU or the USA, they have all created Ponzi schemes which are exponentially bigger than what Ponzi did. Admittedly no government is promising the 50% return that Ponzi did or Madoff’s 10-12%. Instead they are giving investors of their “Ponzi” bonds the illusion that they will receive the capital back. To paraphrase Mark Twain, investors are neither going to get the return ON their money nor the return OF their money, at least not in real terms.

A country cannot survive on nail bars, pizza delivery and Facebook

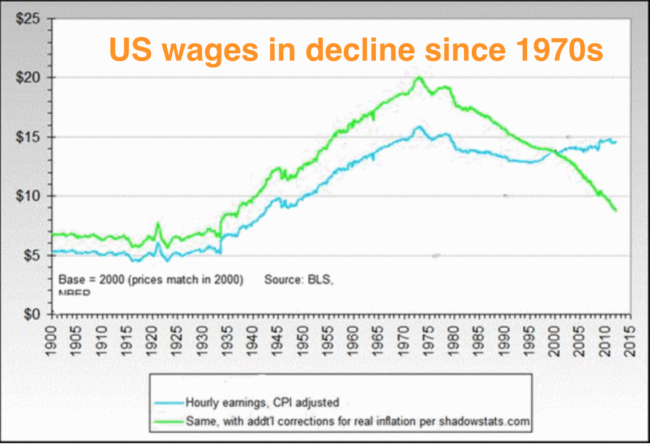

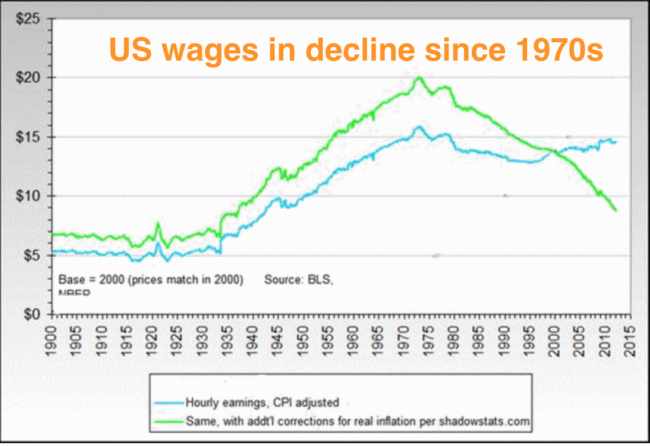

How could any major nation ever repay their debt? Take the US, they have increased their debt every single year since 1960. And at that time it was only $280 billion and today it is $19 trillion. Anyone under the illusion that their investment in US treasuries will be reimbursed in real money needs a reality check. So there goes $19 trillion down the drain. The US used to be a major manufacturing nation. In the mid-1940s manufacturing wages were almost 40% of GDP. Today it is below 10%. A major economy cannot survive on nail bars, pizza deliveries or Facebook, especially since average real wages for the majority of US workers has not increased since the early 1970s. Even worse, profit (EBITDA) growth has turned down since 2010 and is now negative.

China, Japan or EU – which one will be the first to fall?

Leave A Comment