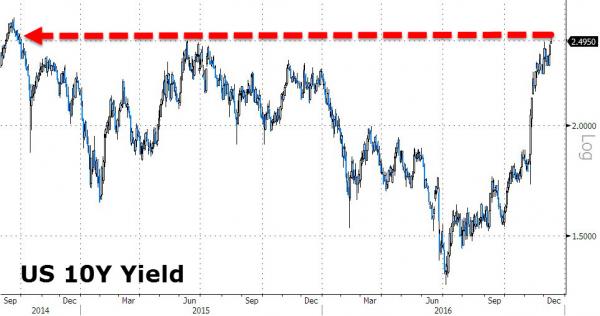

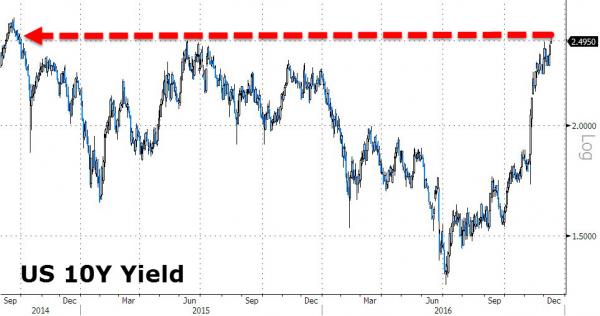

While all the headlines have been about 10Y Treasury yields breaking above 2.50% briefly for the first time since September 2014, the bigger news for the world of bond traders is the utter bloodbath in ultra-long duration European bonds.

10Y Treasury yields broke above 2.50% this morning…

But while US 10Y Bonds have lost around 7% of their value from the August highs, it is the ultra-long duration bonds issued by various European nations over the summer that are collapsing…

Now back below its issuance price. The question is – who holds these and are they mark-to-market insensitive?

Leave A Comment