Cerberus Capital Management has officially eaten its initial investment in Remington as the country’s oldest firearms manufacturer officially filed for Chapter 11 bankruptcy late Sunday after unveiling a plan last month to surrender most of the company’s assets to its creditors. CNNMoney reported that the company agreed to reduce its debt by $700 million through the Chapter 11 process and contribute $145 million to its subsidiaries as part of the deal.

Cerberus will shed its ownership once the bankruptcy is complete.

Falling gun sales in recent years combined with high debt levels and a bleak sales outlook (now that President Trump is in office and Republicans are seen as more likely to protect gun rights) are making life difficult for firearms manufacturers.

Remington, which is buried under nearly $1 billion in debt, announced a debt restructuring plan on Feb. 12, two days before the school shooting in Parkland, Florida. Since then, some retailers have reacted by dropping sales of firearms – most notably Dick’s Sporting Goods, which announced a ban on the sale of assault rifles and Walmart, which raised the minimum age to buy guns to 21.

Remington makes the Bushmaster AR-15-style rifle that was used in the Sandy Hook shooting in Connecticut that left 20 first-graders and six educators dead in 2012. The company was cleared of wrongdoing in the shooting, but investors swiftly shunned Cerberus Capital Management, the company’s owner, according to the Associated Press.

Gun makers have reported precipitous declines in profits over the past year thanks to the drop in sales.

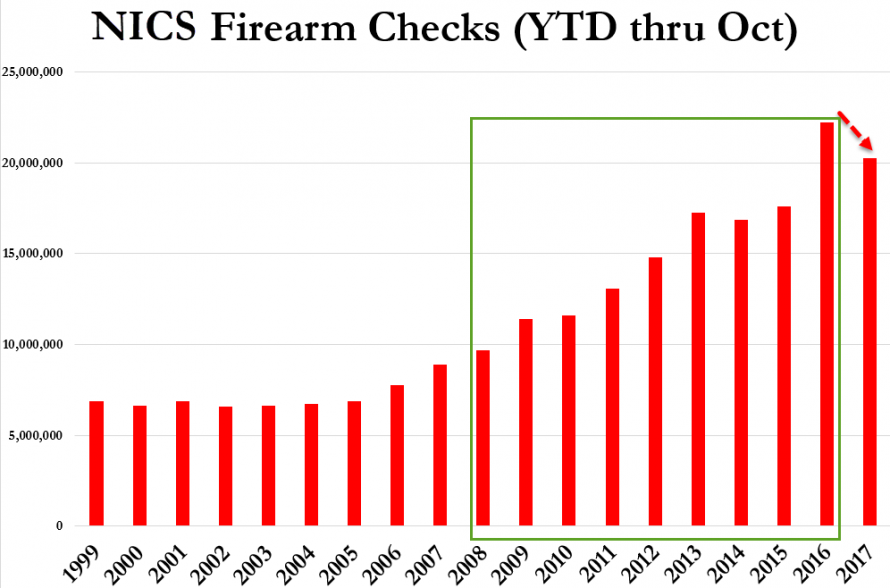

After 8 years of almost incessant rises in NICS Firearms Checks (a proxy for ‘legal’ arms sales) under President Obama, the number of checks declined last year.

Remington announced in February that it would reduce its $950 million debt load in a deal that will transfer control of the company to creditors. It plans to wrap up its bankruptcy as soon as May 3, according to CNNMoney.

Leave A Comment