So as with all passive ETF posts, we have to put the word “dumb” in scare quotes.

Why? Well, because it’s not entirely clear whether these flows are actually so “dumb” after all.

Indeed, in a market that only goes up, this “dumb” money is the “smartest” money there is. In fact, as we wrote in “There’s No Diversification: When This Ship Sinks, We’re All Going Down With It,” hedge funds (and especially macro hedge funds YTD) have had a really, really tough time outperforming benchmarks that benefit from the “rising tide” that’s “lifted all boats” for the past 8+ years.

However you want to characterize it, there’s one indisputable fact here: the “dumb” money is becoming a larger and larger part of the tape.

As Goldman writes in a great piece out this afternoon:

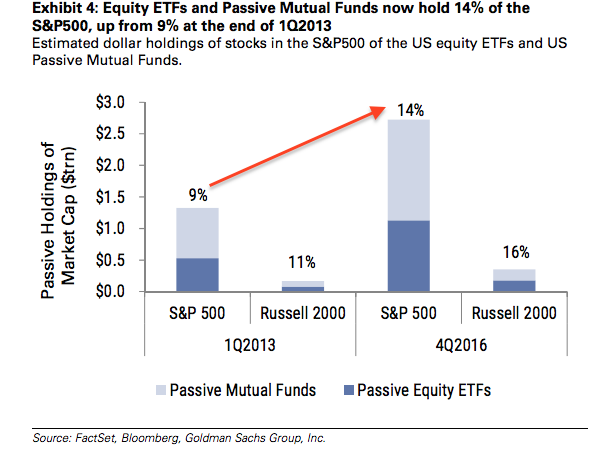

- 14% of the S&P 500 is owned by passive: We estimate 6% of the market cap is held by ETFs, another 8% by passive mutual funds. This is up from 9% as of 1Q2013.

- 16% of the Russell 2000 is owned by passive: We estimate 8% of the market cap is held by ETFs, another 8% by passive mutual funds. To put this in comparison, passive held 11% of the Russell 2000 as of 1Q2013 quarter end.

Leave A Comment