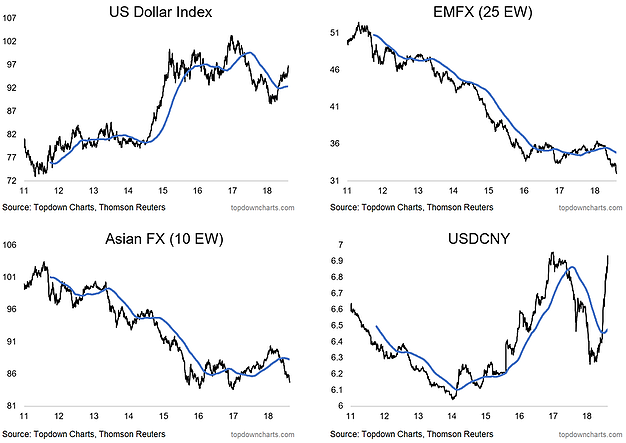

Well, it’s a mouthful of a title, but sometimes you just have to say exactly what’s in the post and today we’re looking at 4 charts-in-one… and they are about as topical as it comes. The charts come from our weekly Global Cross Asset Market Monitor: the top left is the US dollar index, the top right is an equal-weighted emerging market currency index (25 currencies vs USD), the bottom left is an equal-weighted index of 10 Asian currencies vs the USD, and the bottom right, of course, is the Renminbi against the US dollar (USDCNY). Bottom line is there is a big move underway across global foreign exchange markets right now, and it’s quite likely there’s more to come.

What’s driving this, aside from a few idiosyncratic issues (e.g. Turkey – which I believe is simply a symptom of a wider issue), is monetary policy divergence, a subtle desynchronization of global growth, and softening macro picture in China. Fed tightening (rate hikes and QT) is a key catalyst, and the trade war just adds fuel to the fire. I talked previously about how Fed tightening and a stronger dollar is going to put stress on emerging markets, and the charts above show basically this thesis in action. The biggest risk is that you get a feedback loop of stronger dollar >> EM stress >> stronger dollar >> and so on. As previously noted, the USDCNY going through 7 could be a critical test (aka nail in the coffin) for the low volatility environment, and as I write the USDCNY is trading just over 6.933, so this test may come sooner than you expect…

Leave A Comment