Let’s talk about Qatar and more specifically about the riyal, which is of course pegged to the dollar at 3.64.

Back in June, Saudi Arabia cobbled together a coalition of Arab states and moved to scapegoat Doha for what, if everyone is being honest, has always been a group effort to support Sunni extremism.

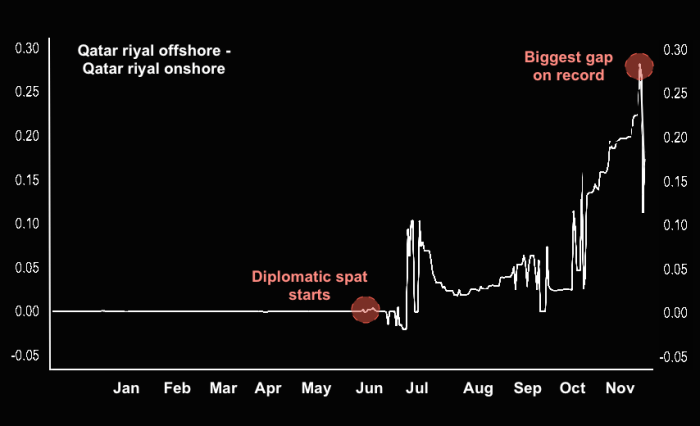

Pretty much immediately after the diplomatic crisis began, twelve-month forward points leapt as everyone suddenly began to bet that Qatar would be forced to devalue. Qatar’s central bank pushed back and has repeatedly contended that it can defend the peg which has been in place since 2001.

As you can imagine, the gap between the onshore rate and the offshore rate began to blow out. That trend has generally continued and the gap hit a record last week:

Well that discrepancy right there has led MSCI to suggest that the offshore rate needs to be used to value Qatari stocks because apparently, people are complaining that the Saudi-led boycott is curtailing access to the onshore rate.

Needless to say, Qatar’s central bank thinks that’s a whole lot of bull*#$*. Here’s what the bank said in an e-mailed response to Bloomberg:

There are no restrictions on any banking transactions, including transfers. The offshore rate“is not reflective of the Qatari market fundamentals, and all banks in Qatar execute transactions using the on-shore rate.

Just to be clear, the worry here is that a move like that from MSCI could further undermine confidence. In a statement, MSCI said its new calculation would alter index levels and performance, market capitalization, fundamental data, and annualized traded value ratios.

Apparently, MSCI is going make this decision by December 5. Meanwhile, Qatar’s benchmark is the worst-performing index on the planet this year – or at least among those tracked by Bloomberg. Have a look:

“If MSCI’s change its calculation to an offshore rate we expect more institutional outflows (passive) and retail outflows to continue,” Aarthi Chandrasekaran, vice president for research at Shuaa Capital in Dubai said last week, adding that “banks will be affected most by such a move [as the] main constituents of MSCI Qatar Index are QNB, Masraf Al Rayan, QIB, CBQ and Doha bank.”

Leave A Comment