Periodically I present updated information about consumption from capital and labor income. Using the NIPA accounts and labor share, I can separate consumption by capital and labor.

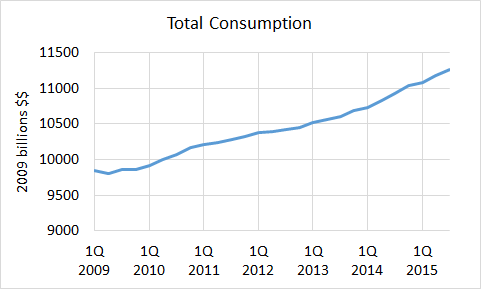

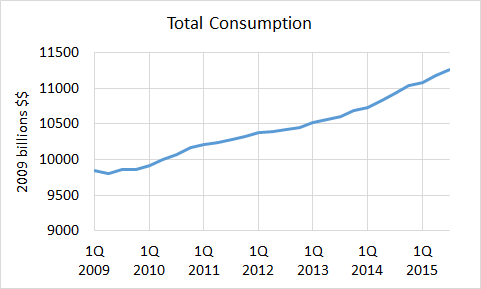

Total consumption is trending steadily upward.

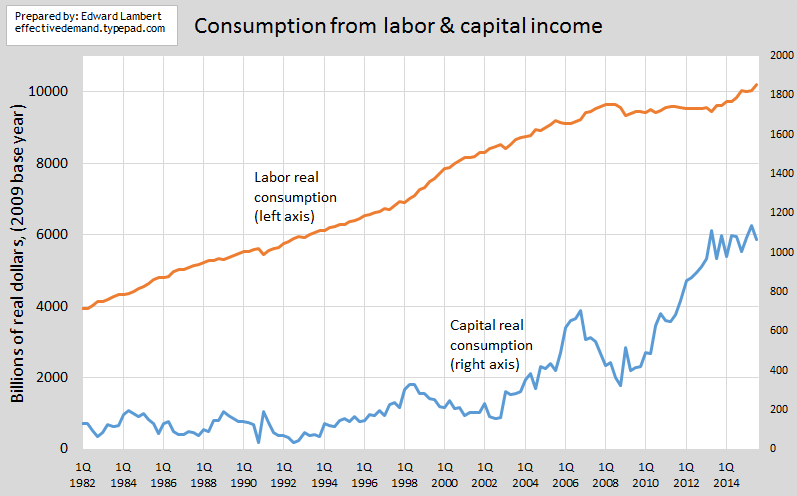

Even with consumption trending steadily, in 2013 consumption by capital income began to move sideways, while consumption by labor income began to rise. It may be that labor-income consumption has returned to its pre-1999 trend. (In the graph below the amount of consumption is an estimate. The purpose of the graph is to show how the consumption is trending overtime. The actual amount may be above or below what is shown.)

Capital-income consumption is at a historically high level but leveled since 2013.

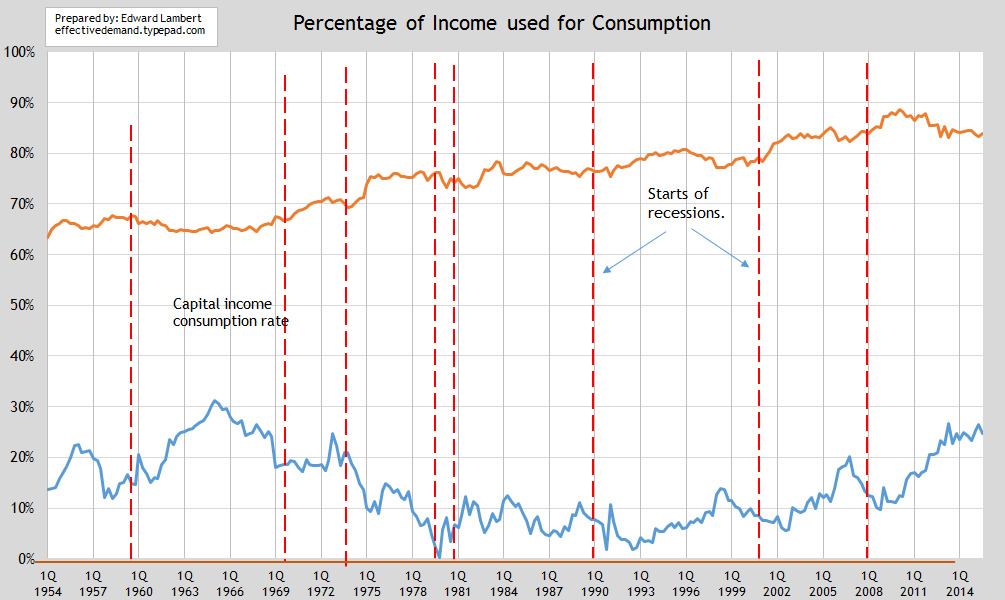

National income has been shared with labor in the last couple of years to the extent that labor has been able to use less of their income for consumption than just after the crisis.

I watch to see if capital consumption is declining, which is one signal of an approaching recession. No decline yet as of 3rd Q 2015… Capital income was still enjoying their tremendous bounty since the crisis.

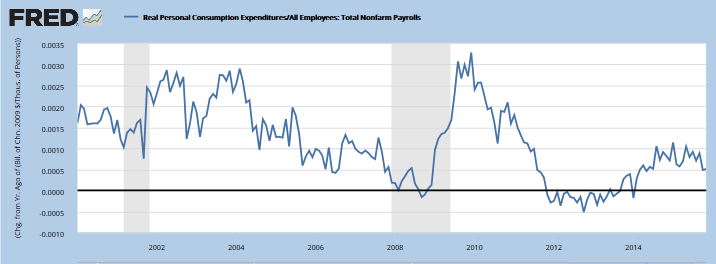

To support the graphs above, consumption per employee began rising in 2013… and has been recently coming down. So rises in labor income are going less than 1-for-1 into consumption. (link)

The returns to business for raising labor income may be diminishing.

Leave A Comment