Written by Eric Bush, CFA, Gavekal Capital Blog

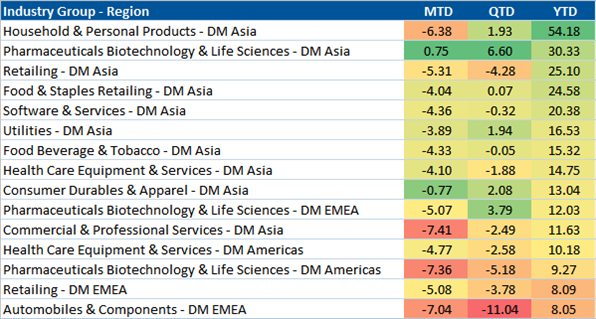

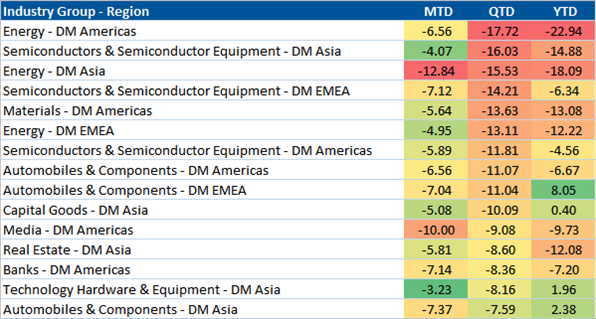

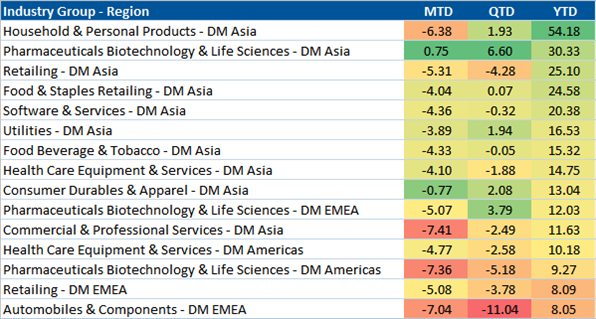

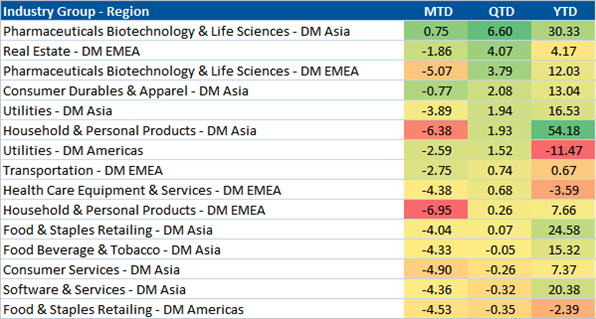

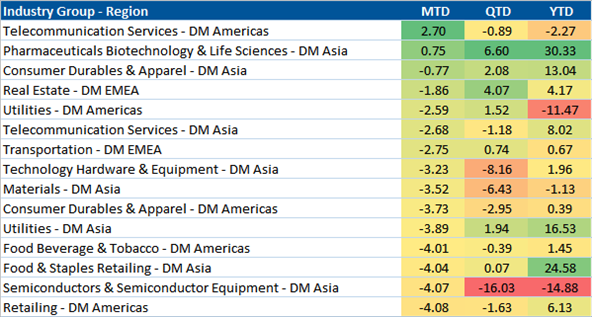

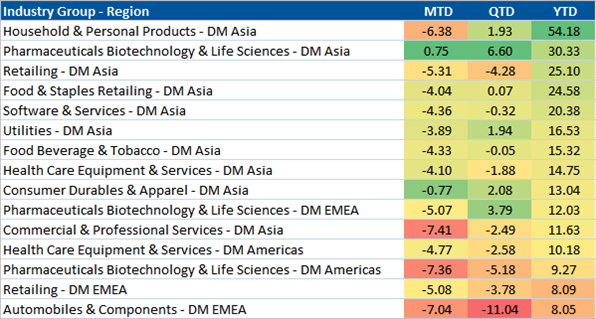

With last week’s volatility in the books, we thought it would be worth taking a moment to check in on equity performance across the developed world. In the tables below, we are looking at performance data on an equal-weighted, USD basis and grouped by regional industry group. So for example, the best performing industry group in the developed world YTD are Asian Household & Personal Product stocks. This industry group is up a very strong 54% YTD.

The main takeaways are:

Asian equity exposure has been key to outperformance this year. The nine best performing industry groups and 13 out of the top 20 are out of Asia.

North American equity returns have been poor and leadership continues to narrow. Only two out of the top 22 industry groups come from North America. And both of these industry groups, Health Care Equipment & Services and Pharmaceutical, Biotechnology & Life Sciences, are from the Health Care sector.

Even after last week, the majority (44 out 72) industry groups are still positive YTD.

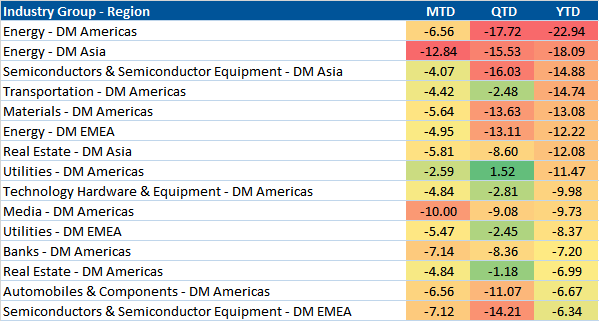

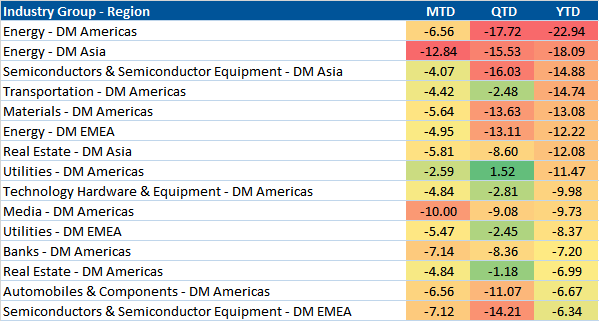

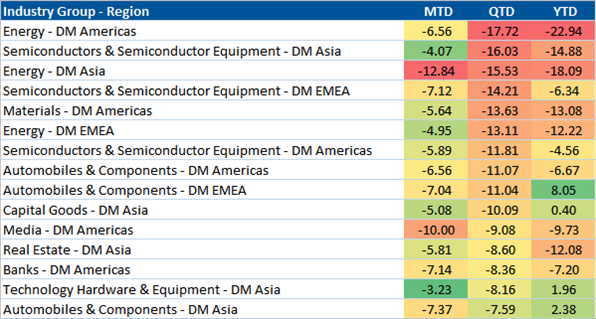

Energy equity returns remain weak. The two worst performing industry groups are North American Energy (-22.94%) and Asian Energy (-18.09%).

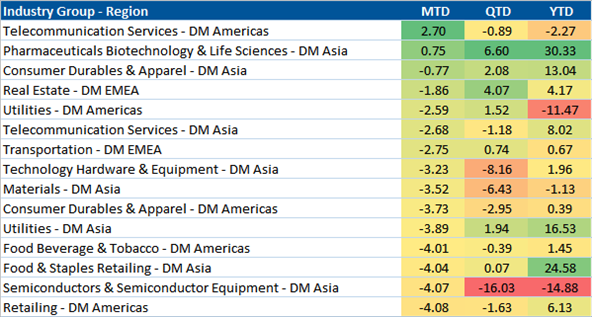

Semiconductors & Semiconductor Equipment industry groups have been weak across all regions QTD. They account for three of the worst seven performing industry groups in the 3Q.

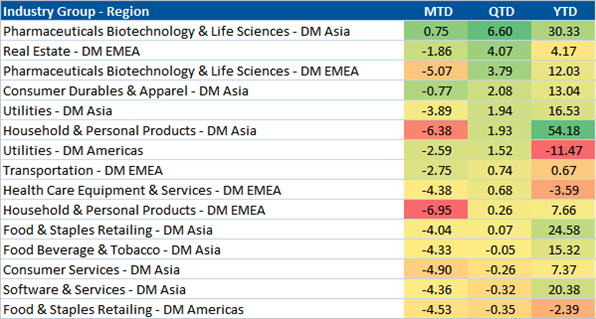

Only 11 out of the 72 industry groups have positive performance in the 3Q. And counter-cyclical sectors (Health Care, Consumer Staples, Utilities) dominate performance.

10 industry groups are have declined by at least 10% in the 3Q.

70 out 72 industry groups are down MTD.

Top 15 Regional Industry Groups YTD

Top 15 Regional Industry Groups QTD

Top 15 Regional Industry Groups MTD

Bottom 15 Regional Industry Groups YTD

Bottom 15 Regional Industry Groups QTD

Bottom 15 Regional Industry Groups MTD

Leave A Comment