Yesterday I was having a conversation with a colleague that spanned a wide range of topics from investment research sources to best business practices. During the course of our dialogue the concept of recessions and bear markets came up and it sparked a question that I think many people are asking themselves:

Can we have a typical bear market in the U.S. without the sobering reality of a full blown recession?

My answer is yes and let me tell you why.

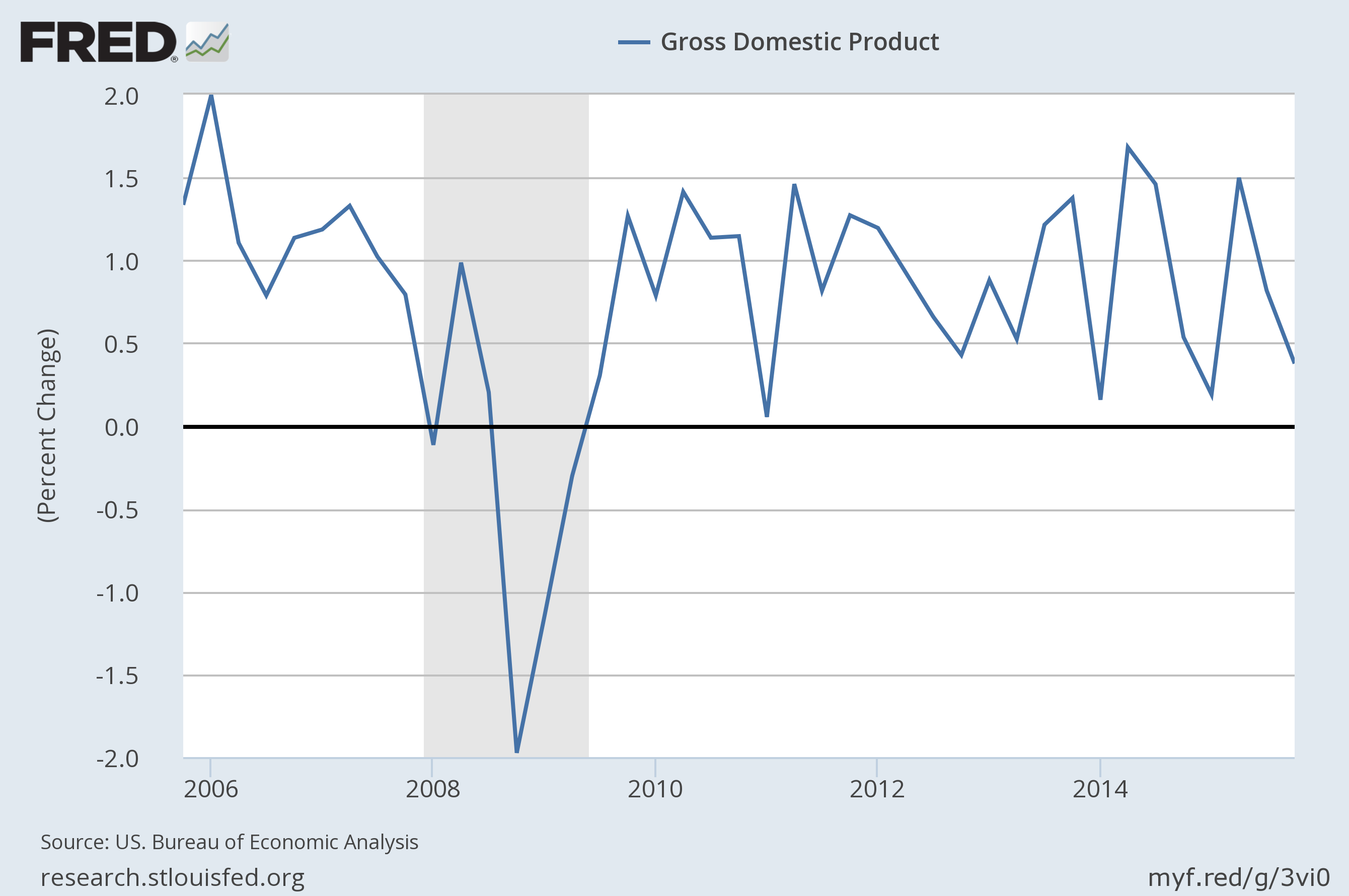

For starters, the most common definition of a bear market in stock is a 20% drop in the major indices from their highs. Additionally, a recession is defined as back to back quarters of negative economic growth as measured by Gross Domestic Product (GDP). Many will dispute those arbitrary analytics, but they are still considered by a vast majority to be the overriding measures of these occurrences.

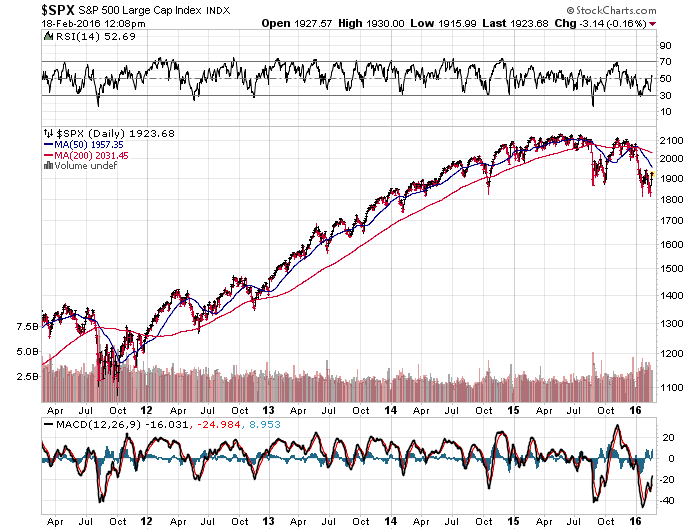

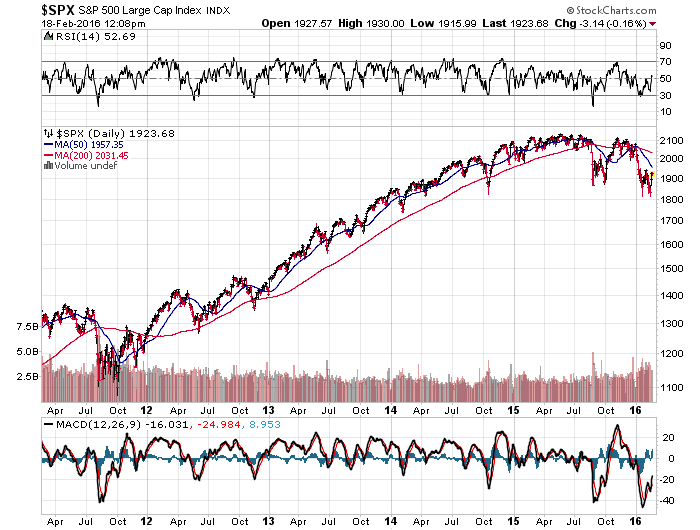

During this conversation, I brought up the example of 2011, when the S&P 500 Index fell by 19.38% from high to low on a closing basis. Many don’t consider this to be a bear market although it literally just missed the mark by a handful of basis points. If you actually took the intra-day highs and lows, it would have made the cut off.

We can debate for days what caused the 2011 sell off and subsequent recovery, but the overriding truth is that the event was over in a matter of three or four months. It started with a big August drop, a small recovery, a retest of the lows, and then on to new highs. Over and done with in a relatively short period of time.

Now when we turn to the chart of the quarterly change in GDP, it’s easy to see that productivity remained above the flat line throughout that event. No calls for a recession or other black mark on the overall health of the economy.

In my opinion, this example shows that we can have a very fast down swing in the market that is accompanied by a swift recovery without the fear of a recessionary environment. Could the 2016 market fall 20, 25, or even 30% and then rocket back to safety in a matter of months? Absolutely. I’m not saying that is going to happen, but we can’t rule it out either.

Leave A Comment