“Index points to little change in economic growth in January .” This is the headline for this morning’s release of the Chicago Fed’s National Activity Index, and here is the opening paragraph from the report:

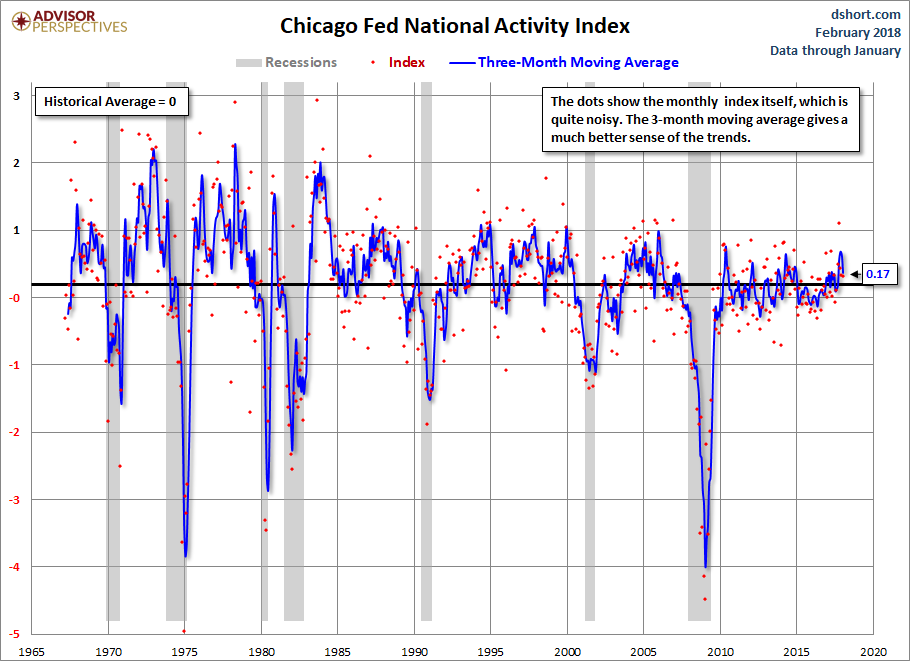

The Chicago Fed National Activity Index (CFNAI) ticked down to +0.12 in January from +0.14 in December. Two of the four broad categories of indicators that make up the index decreased from December, and two of the four categories made negative contributions to the index in January. The index’s three-month moving average, CFNAI-MA3, decreased to +0.17 in January from +0.43 in December. [Link to News Release]

The previous five of six months were revised.

Background on the CFNAI

The Chicago Fed’s National Activity Index (CFNAI) is a monthly indicator designed to gauge overall economic activity and related inflationary pressure. It is a composite of 85 monthly indicators as explained in this background PDF file on the Chicago Fed’s website. The index is constructed so a zero value for the index indicates that the national economy is expanding at its historical trend rate of growth. Negative values indicate below-average growth, and positive values indicate above-average growth.

The first chart below shows the recent behavior of the index since 2007. The red dots show the indicator itself, which is quite noisy, together with the 3-month moving average (CFNAI-MA3), which is more useful as an indicator of the actual trend for coincident economic activity.

For a broad historical context, here is the complete CFNAI historical series dating from March 1967.

The next chart highlights the -0.7 level. The Chicago Fed explains:

When the CFNAI-MA3 value moves below -0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun. Conversely, when the CFNAI-MA3 value moves above -0.70 following a period of economic contraction, there is an increasing likelihood that a recession has ended.

Leave A Comment