Eswar Prasad makes the case in a NYT column that we should be paying attention to selection of Yi Gang to head China’s central bank as a result of China’s status as the world’s second-largest economy. Prasad is right about the importance of China’s central bank in the world economy, but it is worth noting that by purchasing power parity (PPP) measures China is already by far the world’s largest economy.

Purchasing power parity calculations of GDP attempt to measure all the goods and services produced by a country with a common set of prices. This means we add up all the cars, tables, haircuts, knee surgeries etc. produced in both the U.S. and China and assume that each item costs the same in both countries.

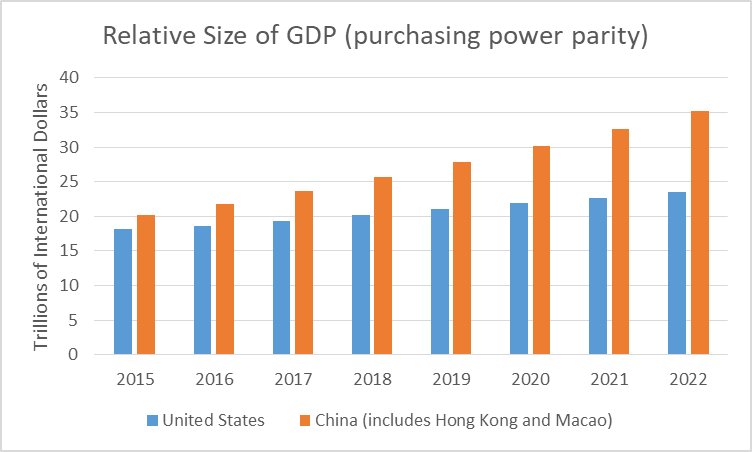

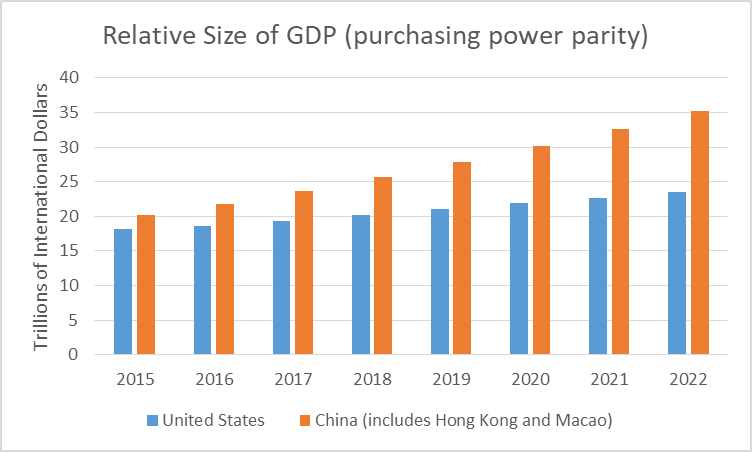

According to the projections from the I.M.F. China’s GDP is already 25 percent larger by this measure and will be almost 50 percent larger by the end of the projection period in 2022, as shown in the figure below.

Source: International Monetary Fund.

The U.S. economy is still considerably larger using the exchange rate measure of GDP, but for many purposes, the PPP measure is more appropriate. For example, if we want to gage the extent to which China’s exports of steel or other items may affect world markets we would want to know the PPP measure of output, not the exchange rate. Also, if we are looking at living standards, we would want to look at per capita GDP using the PPP measure. (Since China has four times the population of the U.S., it is still less than one third as rich on a per person basis.)

The PPP measure is also not subject to wild swings like the exchange rate measure. This means, for example, if the Chinese currency were to rise by 20 percent against the dollar, the exchange rate measure of GDP would rise by 20 percent. The PPP measure would not be affected.

Leave A Comment