Back in December, New York-based China Beige Book International released what they called a “disturbing” set of data that pointed to pronounced weakness in the Chinese economy.

“National sales revenue, volumes, output, prices, profits, hiring, borrowing, and capital expenditure were all weaker than the prior three months,” the firm – whose CBB is modeled on the Fed’s survey of US economic conditions and is supposed to provide a more objective assessment of China’s economic health than the goal-seeked figures that emanate from the NBS – remarked.

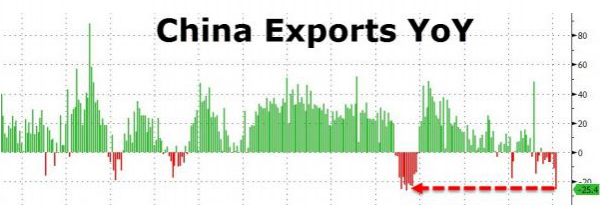

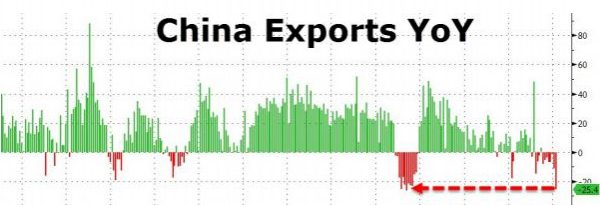

In the three months since the CBB’s last report, we haven’t seen a whole lot in the way of positive data that would have caused us to believe that things are looking up. Exports, for instance, cratered more than 20% in RMB terms last month and 25% in USD terms – the third worst performance in history.

Sure enough, the CBB’s latest quarterly read on the Chinese economy betrays more pervasive problems including a persistent lack of hiring and a disheartening dearth of capex. “Only 33% of firms reported capital expenditure growth in the first quarter, the lowest in the survey’s five-year history,”Reuters reports, adding that “the share of firms reporting capex growth has fallen by over 40 percent since the second quarter of 2014.”

The CBB’s survey, which includes 2,200 companies and 160 bankers, showed that although profits have risen, hiring has collapsed to a four-year low and that poses a very real problem for the Party which is perpetually concerned with optics. “The weakness in the job market hits at a paramount concern for the Chinese Communist Party,” WSJ notes, before quoting CBB president Leland Miller, who said the following in the report:

“The party cares very much about the state of the labor market. The first quarter may therefore be one of the rare occasions when investors see the data and react mostly with relief, while the results cause some mild panic back in Beijing.”

Leave A Comment