The policy divergence between the Fed and the PBoC just got wider.

For the fourth time this year, China has cut the reserve requirement ratio for some banks in a bid to counter a deceleration in the economy and ensure trade frictions with the U.S. don’t end up raising the odds of a hard landing.

In late June, China broke with recent precedent by not lifting OMO rates following a Fed hike. That clearly suggested that Beijing was, for the time being, more concerned about shielding the economy than capital flight. Ten days later, the PBoC delivered a long-awaited RRR cut.

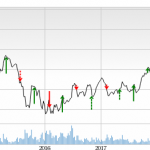

Around that time, the yuan started to depreciate in earnest on the way to a steep slide that ended up zeroing out much of the effects associated with the first two rounds of U.S. tariffs.

As a reminder, the PBoC effectively let the Fed do the work when it came to yuan depreciation. The Fed’s persistently hawkish lean served to widen the monetary policy divergence between the U.S. and China and Beijing countenanced that divergence and the currency depreciation that came with it. By early August, the yuan seemed to have a date with a 7-handle at which point China stepped in to slam on the brakes with a series of measures, culminating in the reinstatement of the counter-cyclical adjustment factor on August 24.

(Bloomberg w/ annotations)

Starting in late July, China began to tip fiscal stimulus and late last month, Premier Li Keqiang announced tax cuts and pledged not to devalue the yuan in the course of fighting the trade war.

Over the past week (while Chinese markets were slumbering), tensions between Washington and Beijing were ratcheted up further following Bloomberg’s blockbuster “tiny spy chip” exposé and Mike Pence’s contention that China is meddling in U.S. elections.

That led to trouble in Hong Kong and large declines for some Asian tech shares. The offshore yuan fell this week with the onshore market shuttered.

Leave A Comment