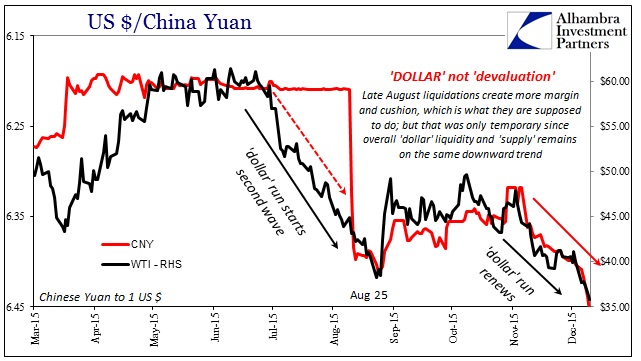

There are times when you can distill the utterly complex into something elegantly simple. This is one of those times, as there really should be no doubt as to “what” and “why” about December so far. From repo to crashing EM’s to crude oil, the common theme is both eurodollar and Asian “dollar.” In that sense, it might be fair to craft the simple equation of; eurodollar = source; Asian “dollar” = destination. The eurodollar banks create global liquidity that ends up in Asia, largely China. In December that is the case only in reverse and only in continuation of these overriding trends in bank balance sheet behavior (contraction and withdrawal).

Again, this is quite simple even if how it actually and exactly got from A to B is dauntingly multifarious:

While it is tempting, especially in the mainstream, to just chalk that up to coincidence of China’s marginal setting in the global economy, we cannot forget that CNY is not an idle exchange of “capital flows”, it is the nexus of wholesale “dollar” and internal renminbi.

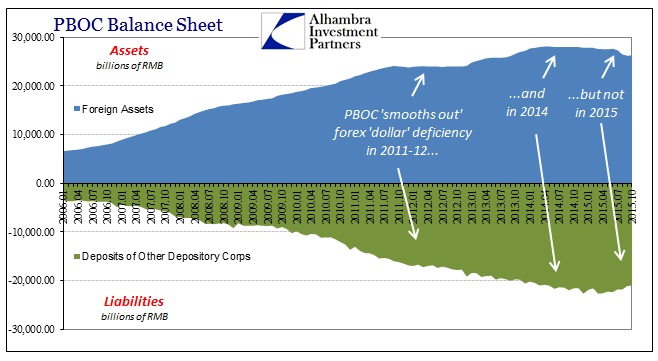

What the liability side of the PBOC’s balance sheet expresses is, in basic, orthodox terms, “money” being “destroyed” inside China. The reason that amount of yuan is doing so is because “dollars” are being “destroyed” externally, forcing the PBOC to answer – which it has, imperfectly, this whole time. The implications are severe and far beyond China.

Leave A Comment