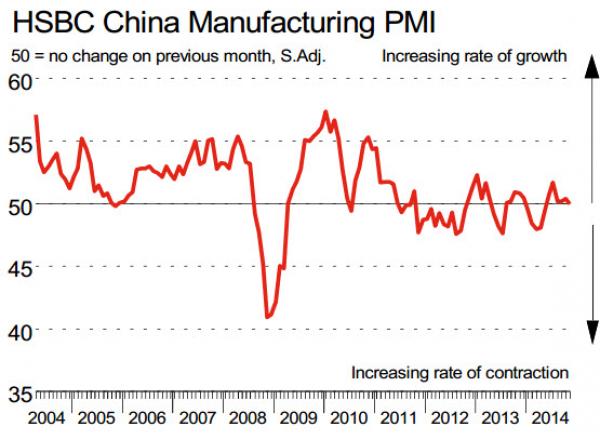

From exuberant credit-fueled cycle highs in July, China’s official Manufacturing PMI has done nothing but drop as the hangover-effect from the credit-impulse weighs once again on the now commodity-collateral crushed nation. At 50.3 (missing expectations of 50.5 for the 2nd month in a row), this is the lowest print since March. All 5 components dropped led by notable weakness is outout and new orders (new export orders biggest MoM drop in 17 months) with medium- and small-enterprises heading deeper into contraction (at 48.4 and 47.6 respectively) as the Steel industry PMI craters to 43.3. Japan’s PMI dropped marginally to 52 and then HSBC’s China Manufacturing confirmed the government data and flash reading with a 50 print – the lowest since May as New Export Orders growth slowed for the 2nd month.

And HSBC China Manufacturing at the lowest since May

Of course, this weak data is great news…

“The HSBC China Manufacturing PMI fell to a six-month low of 50.0 in the final reading for November, down from 50.4 in October and unchanged from the flash reading. Domestic demand expanded at a sluggish pace while new export order growth eased to a five-month low. Disinflationary pressures remain strong while the labour market weakened further. Today’s data suggest that the manufacturing sector lost momentum and point to weaker economic activity in November. The PBoC’s rate cuts, delivered on the 21st November, will help to stabilise property and manufacturing investment in the coming months. We continue to expect further monetary and fiscal easing measures to offset downside risks to growth.”

* * *

Then it was Japan’s turn as its PMI fell slightly, remaining oddly flat around 52 for the last 4 months – “However, the outlook for Japanese goods producers remains uncertain amid the weakening currency, the postponement of the planned sales tax increase and the upcoming election.”

Leave A Comment