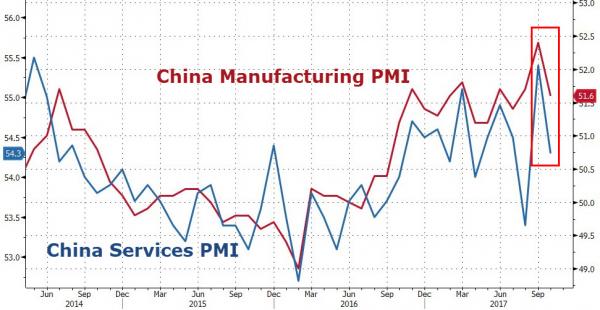

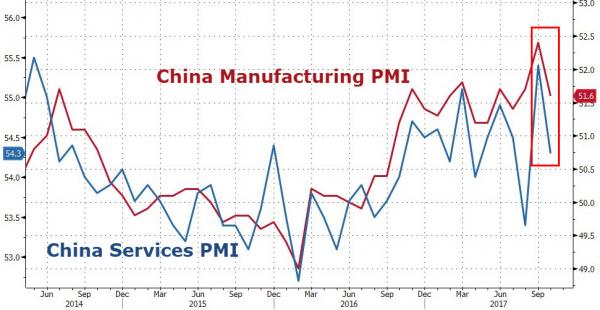

China manufacturing PMI tumbled from 5-year highs in October as officials increasingly prioritize a campaign to clamp down on polluting industries and rein in debt. Non-manufacturing took an even bigger hit, also disappointing expectations, as the lagged impact of China’s deteriorating credit impulse begins to weigh…

As Bloomberg reporets, factories closed and others reduced production in some regions to curb pollution as the winter heating season approaches. With the economytransitioning away from a growth-at-all-costs model, officials are prioritizing the environment and a push to tame credit growth, key policy directions highlighted during the twice-a-decade Communist Party Congress this month.

“Manufacturing optimism likely cooled in China,” Katrina Ell, an economist at Moody’s Analytics in Sydney, wrote in a report ahead of the data. Support from the housing market, which has soaked up excess supplies of cement, steel and other products, will also probably fade in coming months, she wrote.

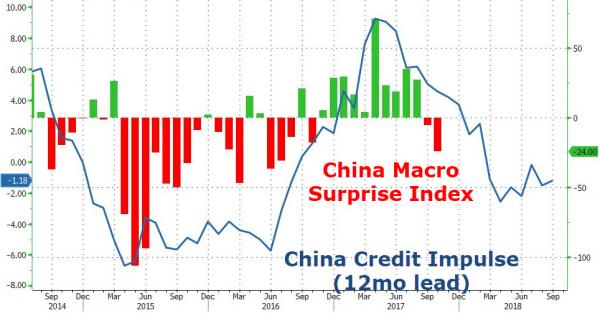

Macro data disappointments are continue to track the lagged credit impulse…

As we noted previously, with the Congress now over, so is the period of coordinated global growth. Here’s why.

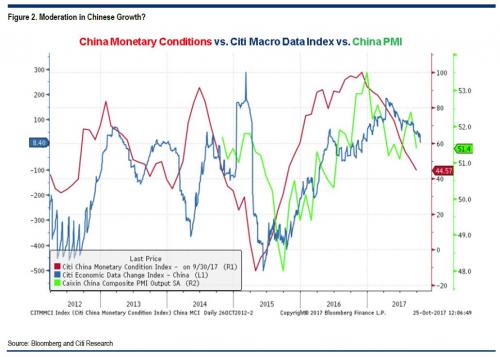

As Citi writes, “China’s Party Congress has concluded and Xi Jinping’s position as President has been consolidated. Given there are no standing committee members in their 50s, it suggests there are no apparent heirs for Mr. Xi, opening the door for him to stay on beyond 2022. One of the key questions in the run up to the congress was that once power was consolidated, would China accelerate its economic reforms. We think this is unlikely but do expect a moderation of growth, with data momentum perhaps set to continue to slow at its current pace. Note how China’s MCI tends to lead Citi’s macro data index for China and our MCI is still tightening.”

It gets worse.

As Capital Economics writes in its China Activity Monitor note this week, the firm’s China Activity Proxy (CAP) suggests that growth in China slowed last month to the weakest pace in a year and with property sales cooling and officials continuing their efforts to rein in financial risks, Cap Econ thinks that looking ahead “the economy will slow further over the coming quarters.”

Leave A Comment