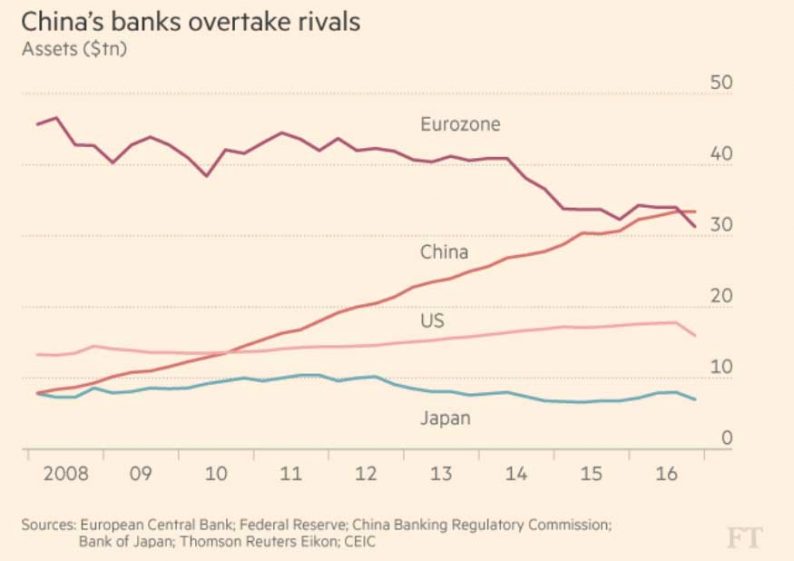

Something historic, if largely unnoticed, took place at the end of 2016: China’s banking system surpassed that of the eurozone, becoming the world’s largest by assets, which according to the FT is a sign of both of the country’s increased influence in world finance and its reliance on debt to drive growth since the global financial crisis. It is also a confirmation that when it comes to interwoven, “Too Big To Fail” financial systems, nothing compares to China and that the onus is on Beijing to keep its banks viable and solvent at all costs.

Chinese bank assets, frequently discussed here and which are also the basis for Kyle Bass’ bearish stance on China, hit $33 trillion at the end of 2016, versus $31 trillion for the eurozone, $16 trillion for the US and $7 trillion for Japan. The value of China’s banking system is now more than 310% the size of its GDP, compared to “only” 280% for the eurozone and its banks.

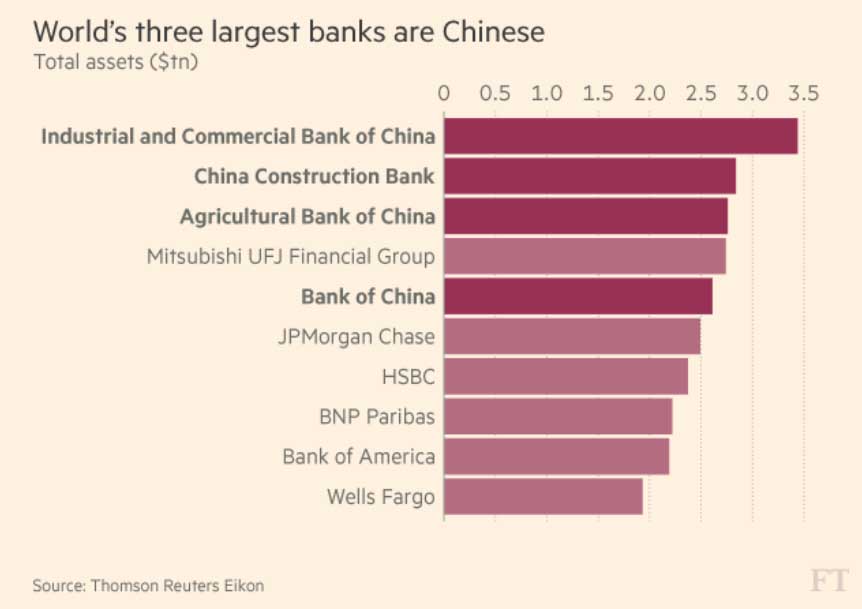

Putting China’s banking dominance in context, 4 of the 5 largest global banks are now Chinese:

“The massive size of China’s banking system is less a cause for celebration than a sign of an economy overly dependent on bank-financed investment, beset by inefficient resource allocation, and subject to enormous credit risks,” said Eswar Prasad, economist at Cornell University and former China head of the International Monetary Fund.

While China’s GDP – goal-seeked as it may be – surpassed the EU’s in 2011, it was not until 5 years later that its banking system took over the top spot. The lag, as the FT notes, “reflects Beijing’s increased “financial deepening” — the term for the growth of a country’s financial system relative to gross domestic product. This has been fuelled by an extraordinary increase in bank lending since 2008 when the government unleashed aggressive monetary and fiscal stimulus to buffer the impact of the global crisis.”

Leave A Comment