from the St Louis Fed

— this post authored by Ana Maria Santacreu and Heting Zhu

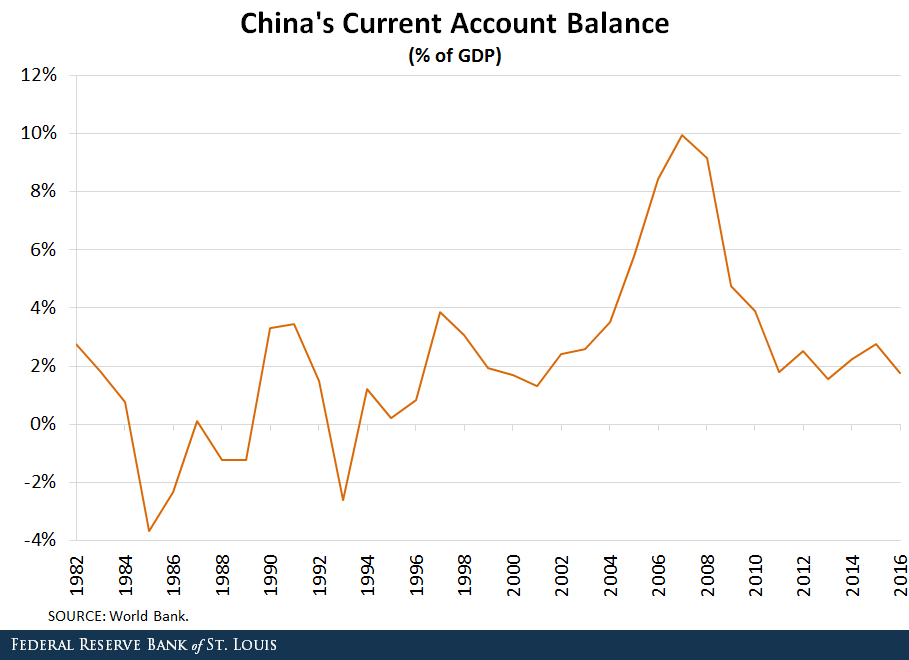

China has been a net lender to the rest of the world since 1994. However, its current account surplus started to decline 10 years ago. Why is this occurring, and what effects might it have on U.S. assets?

A current account surplus implies that, in a given year, the value of goods and services produced exceeds the expenditures made by consumers, investors and the government in China. The figure below shows China’s current account balance for the past few decades.

The difference between production and expenditures in a country accounts for goods and services that are exported to the rest of the world.

Indeed, China’s large current account has been mainly driven by an increase in exports. China has been financing the excess spending of the rest of the world with its current account surplus. China has also experienced capital flowing into the country (i.e., a capital account surplus).

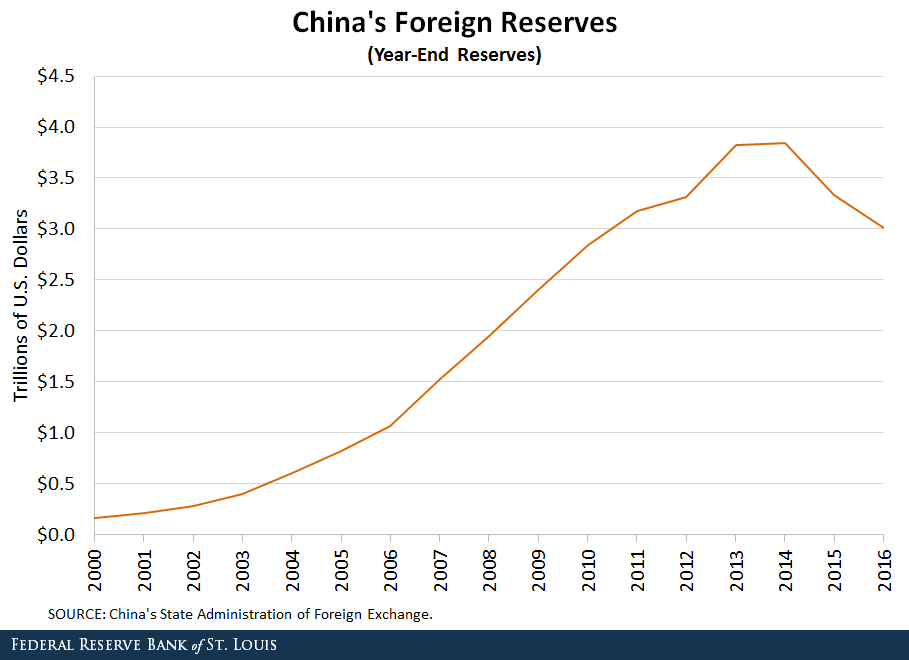

Because of these large current account and capital account surpluses, China has accumulated substantial amounts of foreign reserves. These are composed of cash and other assets denominated in currencies other than China’s yuan.

According to the State Administration of Foreign Exchange in China, these reserves have increased substantially since 2000, reaching $3.8 trillion (in U.S. dollars) in 2014, as seen in the figure below.

The Chinese government’s decision to prevent the appreciation of the yuan has been mentioned as one of the factors explaining the large foreign exchange reserves.1

The Decline in the Current Account Surplus

However, the current account surplus in China started declining 10 years ago. The surplus went from a peak of 9.94 percent of GDP in 2007 to only 1.75 percent in 2016.

Even though this decline started in 2008, capital was not in a rush to leave the Chinese market due to the ongoing Great Recession in the U.S. and most advanced economies. Therefore, China’s central bank did not need to sell foreign assets to maintain the value of its currency and attract foreign investments.

Leave A Comment