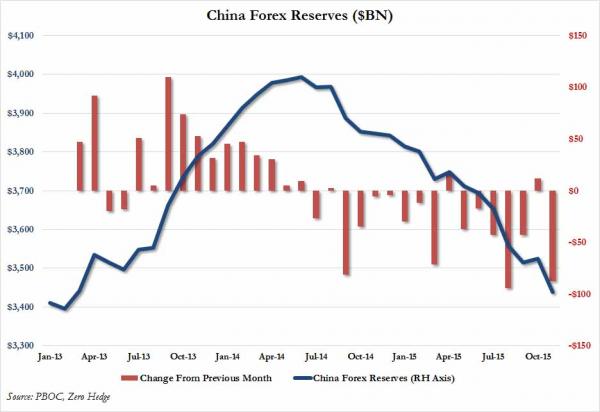

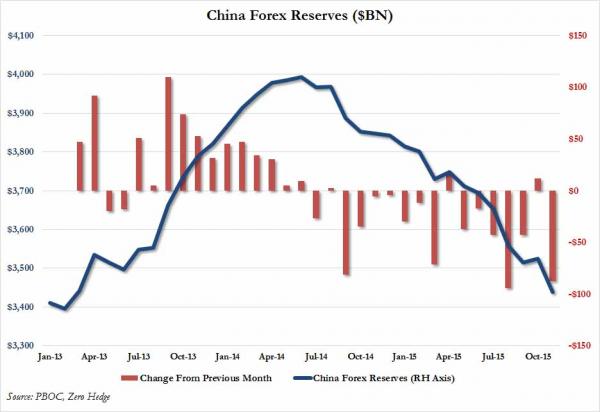

When the PBoC reported the change in Chinese FX reserves for October, some were surprised to learn that apparently, Beijing’s warchest actually grew by $11 billion.

Why was that surprising? Because over the preceding three months, China had liquidated some $300 billion in USTs as Beijing struggled to contain the fallout from the “surprise” August 11 deval.

As it turns out, manipulating the spot to control the fix (versus manipulating the fix to effectively reset the spot) entails quite a bit of intervention when everyone is banking on continued depreciation. So, in order to contain the devaluation and close the onshore/offshore spread, China tapped its FX reserves to ensure that yuan weakness would be “managed” and would unfold on Beijing’s terms, not the market’s.

But October’s reserve data seemed to indicate that suddenly, the pressure on the yuan had dissipated and the outflows had ceased. We would later discover that when you look at the bigger picture which includes bank settlements and forward transactions, the outflows continued unabated during October.

On Monday, we got the latest data from the PBoC which shows that during November, China’s reserves fell by around $87 billion. Stripping out valuation effects, the figure is probably closer to $40 billion (in other words, China probably sold some $40 billion in US paper during the month).

“The figure may not capture all the PBOC’s intervention efforts as the central bank also transacts in the forwards market to support the currency,” Bloomberg notes. And here’s the customary warning from Goldman: “…headline FX reserve data may not necessarily give a comprehensive picture on the underlying trend of FX-RMB conversion by corporates and households.”

In other words, the headline figure likely underestimates the pressure on the yuan and as usual, we won’t get a clear picture for at least another week. Here’s Goldman:

Leave A Comment