China’s plunge protection team may be scrambling to prop up the Shanghai Composite for the duration of the People’s Congress, but the moment the NPC is over, the stock “market” goes with it, and the people know it. But now that China has its favorite bubble back – housing – few care: after all the stock bubble was meant purely as a placeholder until houseflipping mania returns.

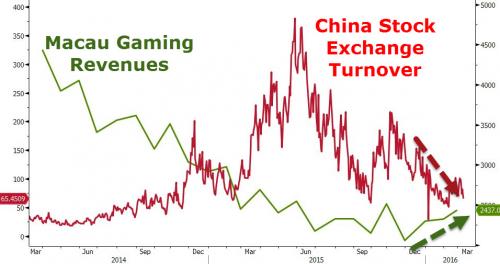

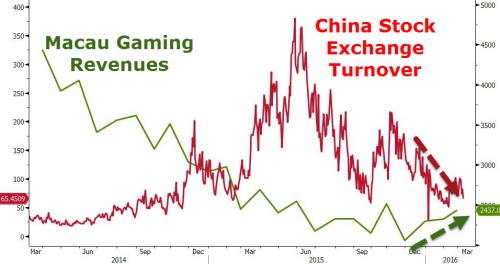

However, the bursting of the stock bubble is hardly bad news, and certainly not for Macau, because now that China’s habitual gamblers no longer have a market where to bet it all, they can finally go back to their original stomping grounds.

Here is Bloomberg’s take with “Macau Casinos Bounce Back as Gamblers Ditch China Stocks”

The wheel of fortune is favoring Macau casino operators over brokerages as gambling revenue stabilizes and turbulence in the equity market weighs on turnover. Shares of Galaxy Entertainment Group Ltd. and Sands China Ltd. are among the biggest gainers in Hong Kong in 2016, after being the two worst performers over the previous two years, while Citic Securities Co. and Haitong Securities Co. are down more than 10 percent. The two-year slump in gambling revenue that was sparked by an anti-corruption campaign coincided with China’s biggest-ever bull market in equities.

As the SHCOMP slides lower, expect the green line to resume its trend higher, which ironically may mean that China casino stocks may be one of the better buys in the local market for the foreseeable future.

Leave A Comment