It’s no secret by now that China has a rather serious debt problem.

Although getting a precise read on it is next to impossible, all told the debt pile probably sums to something like $30 trillion. Various reports put the figure at between 250% and 300% of GDP all-in and as we reported back in January, that may have swelled to more than 340% by the end of 2015.

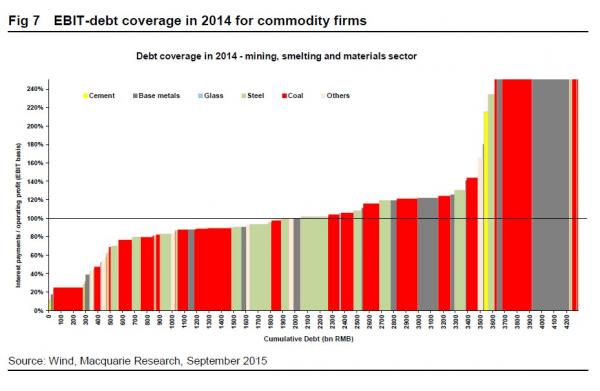

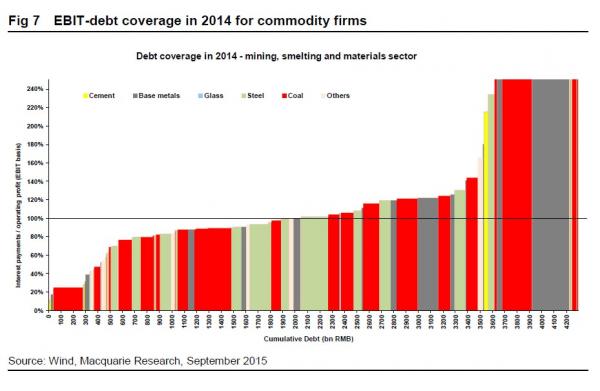

Corporate debt-to-GDP was around 125% in 2014 and probably sits above 150% now. Depending on what business you’re in, servicing that debt has become all but impossible. As Macquarie discovered last autumn, more than half of all debt for commodities firms was EBIT-uncovered in 2014 and heaven only knows what that figure looks like now.

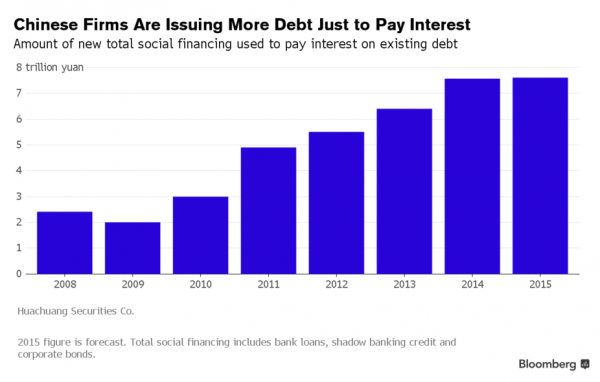

Things have gotten so bad that in 2015, Chinese firms issued $1.2 trillion in new debt just so they could service their existing loans. In other words, China’s entire corporate sector is quickly becoming one giant ponzi scheme.

“Chinese companies are struggling to generate the cash flow needed to service their obligations,”Bloomberg said last November, summing up the situation in the absolute simplest terms possible.

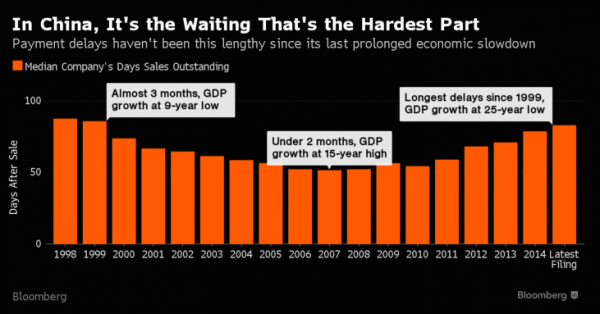

And it’s only going to get worse. On Sunday we learn that median days sales outstanding for mainland domiciled companies now sits at 83 days – the highest in nearly 17 years and double the average for EM as a whole.

As you can see from the above, it now takes 50% longer for Chinese firms to get paid than it did just five years ago. As you might imagine, the problem is particularly acute for industrial firms who are waiting 131 days to convert sales into cash. “A reading of more than 100 days is typically a red flag,” Amy Sunderland, a money manager at Grandeur Peak Global Advisors in Salt Lake City told Bloomberg.

Yes, Amy it certainly is. Especially considering the median for companies in the MSCI Emerging Markets Index is just 44 days.

Leave A Comment