Sweet Authoritative Nothings

There is a mysterious figure making regular appearances in China’s government mouthpiece “People’s Daily”, which simply goes by the name “authoritative person” (AP). This unnamed entity always tends to show up with bad news for assorted speculators, by suggesting that various scenarios associated with monetary and/ or fiscal stimulus are actually not in China’s immediate future (the details of AP’s latest pronouncements can be found here and here).

The People’s Daily. “Authoritative Person” may be hiding somewhere in the picture to the left.

Some observers seem to believe that this represents a “renewed shift in policy” – Bloomberg e.g. quotes an economist with Mizuho Securities as follows:

“It is very significant and may signal a shift in China’s policies,” said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong. “Each time they publish this, it is normally a warning.”

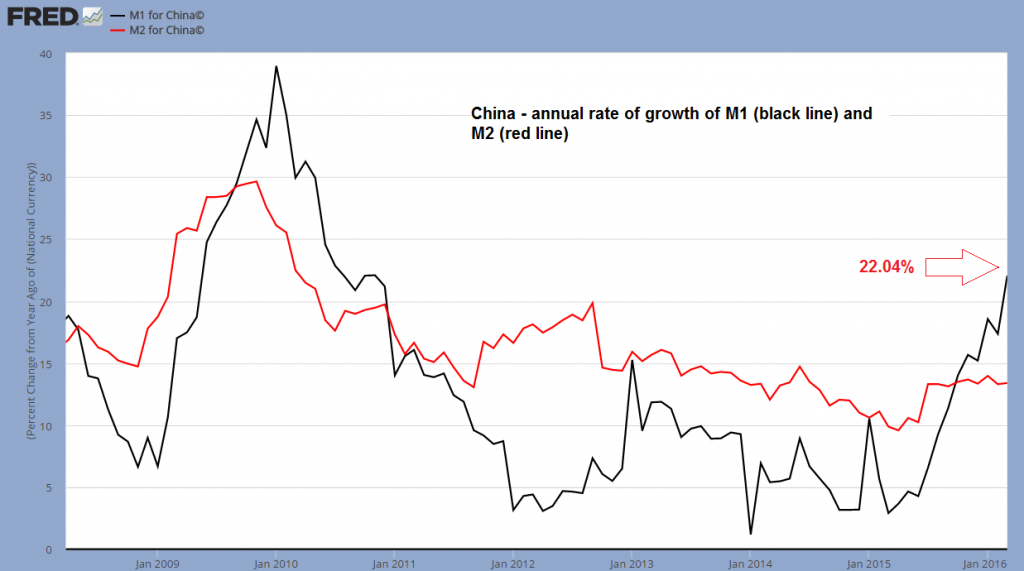

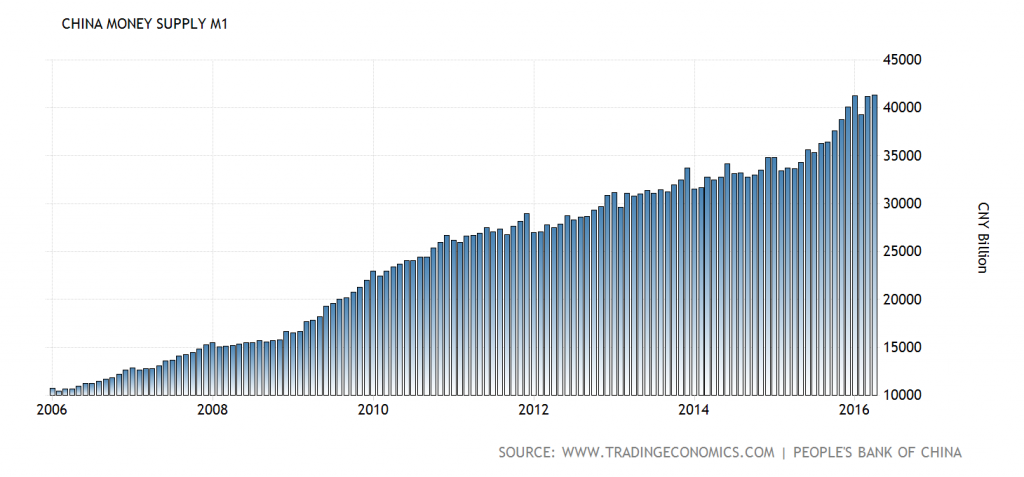

Others are more careful – after all, this seems to be a case of “we’re saying one thing and doing another”, given a credit expansion of 4.6 trillion yuan in just the first quarter, which has sent narrow money supply growth soaring to more than 22% annualized.

The more measured argument is that it could be a sign that the debate about future economic policy is ongoing, resp. has been revived. No-one really knows – it is basically the Chinese version of Kremlinology.

At the end of March, China’s narrow money supply measure M1 was growing at more than 22% y/y.

Although the extension of new yuan loans has slowed significantly in April from January’s heady pace (555 bn. vs. 2.5 trn.), there has still been enough pumping in the system to push M1 up again in March-April from a brief dip in February – in other words, if there is indeed a change in policy, it is not really visible yet.

M1 growth has resumed in March- April after a brief dip in February.

Another sign that the stern admonishments of “authoritative person” are so far more a sign of something thatmight happen, but certainly hasn’t happened yet, is seen in the chart below from CLSA. It shows fixed asset investment growth by China’s state-owned enterprises (SOEs) vs. that of private enterprises. One would think that if “AP” actually had the upper hand right now, there would be a slowdown in SOE capex. The exact opposite is the case:

Leave A Comment