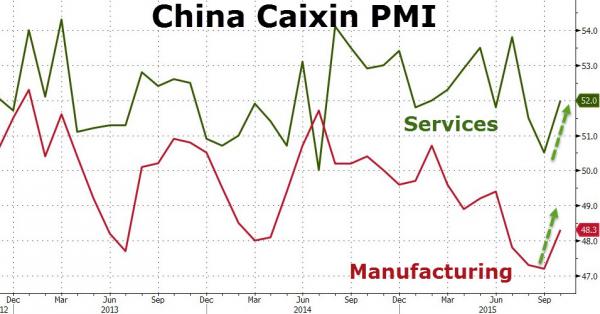

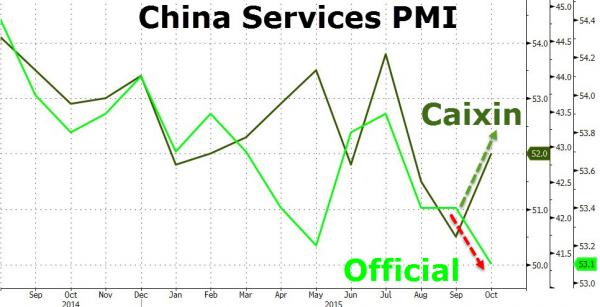

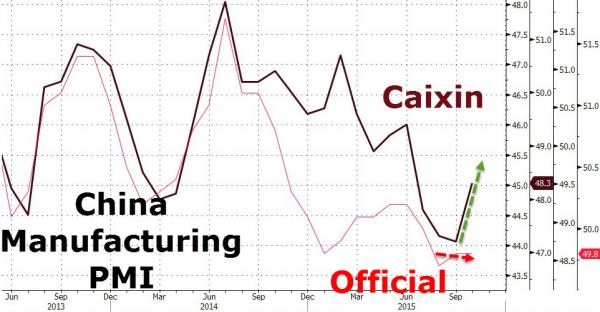

Following Caixin China Manufacturing’s ‘surprise’ jump higher (in the face of the official PMI flat), Caixin Services PMI just beat expectations and bounced considerably to a ‘healthy expanding’ 52.0 (despite official Services PMI plunge), bringing the Composite PMI to 49.9 – thus proving that billions of dollars of liquidity injections, market interventions, debt transfers to SOEs, arrests, shootings, and general thuggery has fixed China. For now stocks are rallying on this news but offshore Yuan is continuing to leak back to Friday’s lows. The biggest gainers are the Chinese brokerages and exchanges (HKEx is up 8%) after PBOC Governor Zhou said a trading link with Shenzhen will start this year.

Is China Fixed?

Who knows?

Chinese stocks are recovering on the ‘good’ news…

Led by brokerages and exchanges…Hong Kong Exchanges & Clearing Ltd. shares surged the most in four months

After the head of China’s central bank said a trading link with Shenzhen will start this year.

HKEx rallied 5.4 percent, heading for the biggest gain since July 9 and extending this year’s advance to 23 percent. China needs to accelerate the opening of its financial markets, People’s Bank of China Governor Zhou Xiaochuan wrote in an article published on the PBOC’s website Tuesday.

An expansion of Hong Kong’s exchange link to Shenzhen after a similar program with Shanghai started last November would come as a surprise to many investors who had anticipated a delay. Ten of the 13 respondents in a Bloomberg survey in September predicted the Shenzhen connect would start next year as authorities focus their efforts on stabilizing the mainland share prices in the wake of a $5 trillion selloff

But it seems the Yuan continues to weaken…

Charts: Bloomberg

Leave A Comment