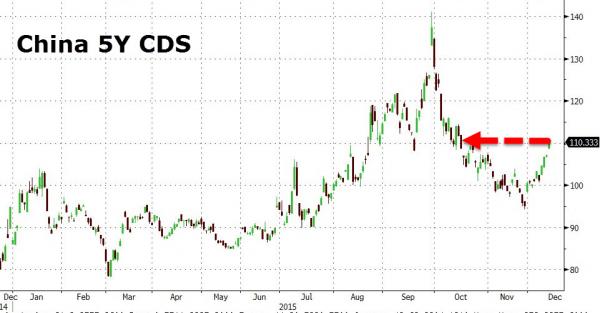

USD/CNY broke above 6.4500 for the first time since the August devaluation, extending its post-IMF plunge to 6 days. This is the largest and longest streak of weakness since March 2014 as China seems to have taken the SDR-inclusion as blessing to devalue its currency drip by drip. Default risk is once again stomping higher as CDS surge from 94bps to 112bps (2-month highs). The biggest news in China tonight is the disappearance of Fosun International’s Chairman, China’s 17th richest man (and the collapse in the company’s bonds, since stocks are suspended).

For the 6th day in a row (something which has not happened since March 2014), Yuan has plunged, now below the August devaluation lows….

The pressure on onshore Yuan (above) is being driven by even more significant selling pressure in offshore Yuan as outflows appear to be accelerating… and PBOC seems happy to “allow” the onshore Yuan to devalue alongside it

to its lowest since July 2011…

And Chinese default risk is on the rise…

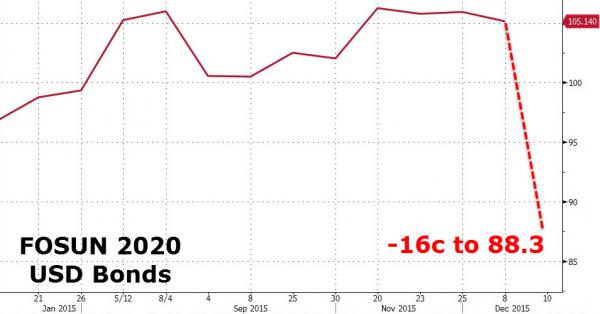

But what everyone is talking about is the disappearance of Fosun International’s chairman.

Its USD 2020 bonds plunged by a record and the company suspended its shares in Hong Kong after Caixin magazine reported that billionaire Chairman Guo Guangchang had gone missing.

The shares declined for a sixth consecutive day on Thursday in Hong Kong, losing 1 percent to close at HK$13.34, and tumbled more than 11 percent to $1.55 in over-the-counter trading in New York. Fosun International dollar bonds fell by a record, with the $400 million of 6.875 percent bonds due in 2020 slumping 16.1 cents to 88.3 cents on the dollar as of 9:10 a.m. in Hong Kong.

Closely held Fosun Group, which controls Fosun International, has “lost contact” with Guo, 48, the magazine said, citing people it didn’t identify.

Leave A Comment