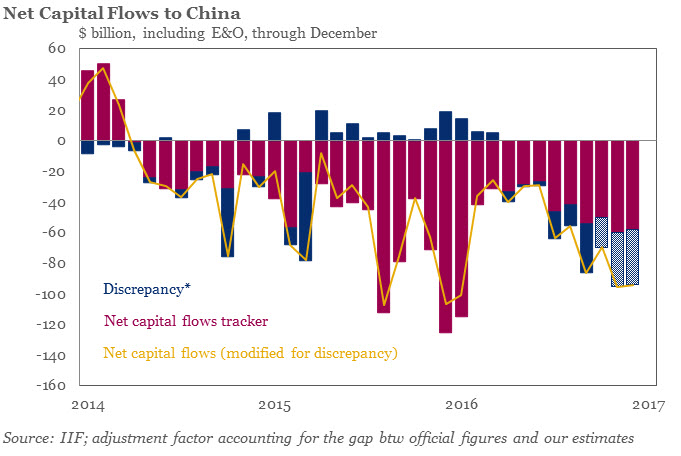

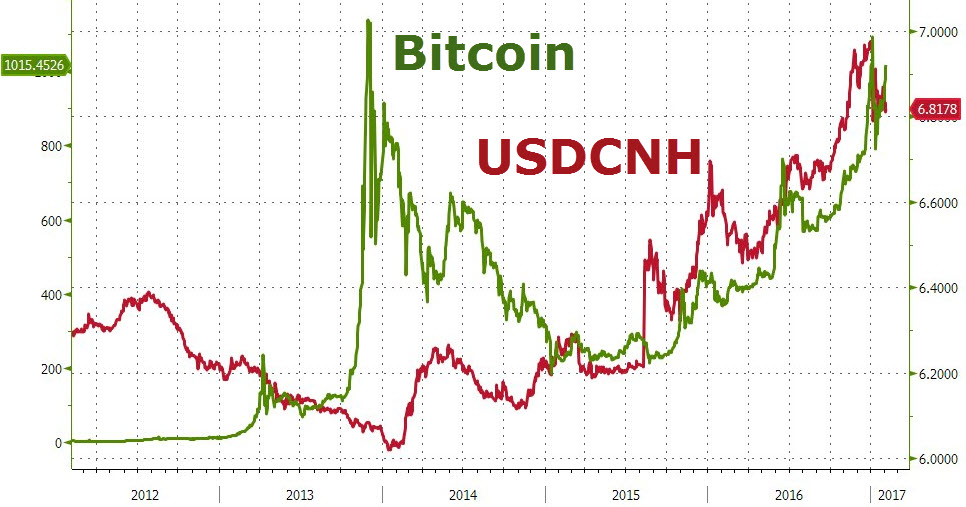

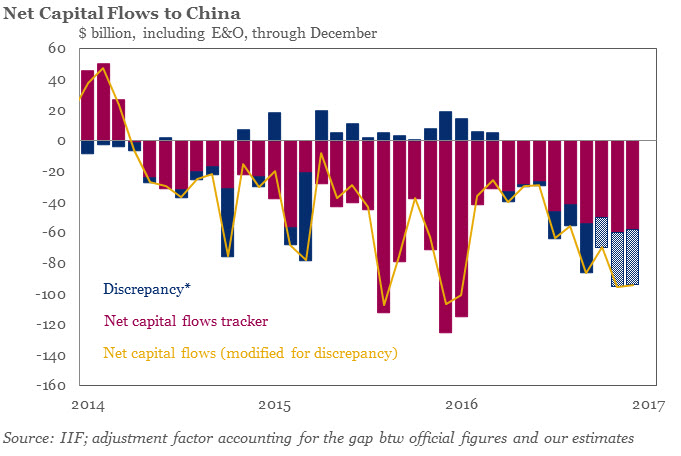

With the Yuan suffering its largest annual decline ever and avenues for capital flight surging in value (Vancouver homes and virtual currencies), it is perhaps not entirely shocking that, according to the Institute of International Finance, capital outflows from China surged last year to a record $725 billion. Furthermore, IIF warns, outflows could accelerate further if U.S. firms face political pressure to repatriate profits.

As Reuters reports, the Washington DC-based group, one of the most authoritative trackers of capital movements in and out of the developing world, estimates net Chinese outflows last year were $50 billion higher than in 2015, dwarfing the inflows other emerging economies received.

Net outflows in 2014 had been just $160 billion from China, which has seen capital flight pick up in the past couple of years from local businesses and households, partly on expectations that the yuan would weaken against the dollar.

The outflows, which caused a $320 billion decline last year in Chinese foreign exchange reserves, have prompted authorities to strengthen capital curbs.

The yuan fell 6.5 percent against the dollar last year, the biggest ever yearly fall, and with capital controls (or suggestions of them) being implemented almost weekly (here, here, and here most recently), it is perhaps no surprise than Bitcoin (one escape valve) has been resurgent in the last few days (amid Golden Week holiday celebrations).

As Reuters reports,, The IIF estimated China outflows at a heavy $95 billion in December and noted that a rise in protectionism, especially in the United States after the election of President Donald Trump, could exacerbate the situation.

Trump and his top trade adviser this week criticised Germany, Japan and China, saying the three key U.S. trading partners were devaluing their currencies to the detriment of U.S. companies and consumers.

“If U.S.-based multinational corporates start to repatriate their profits from China, outflows could worsen further in 2017,” the IIF said, referring to pledges of tax breaks to U.S. firms that bring overseas profits back to the country.

But excluding China, the picture for emerging markets appeared brighter, the IIF said, noting net capital inflows last year had amounted to $192 billion, versus $123 billion in 2015.

In January, inflows into the stocks and bonds of a group of big emerging economies stood at a five-month high of $12.3 billion, the group added.

“January was a much better month for emerging markets but it is too early to tell if this reflects hope for a better outlook – or this is just the eye of the storm,” the IIF note added.

Leave A Comment