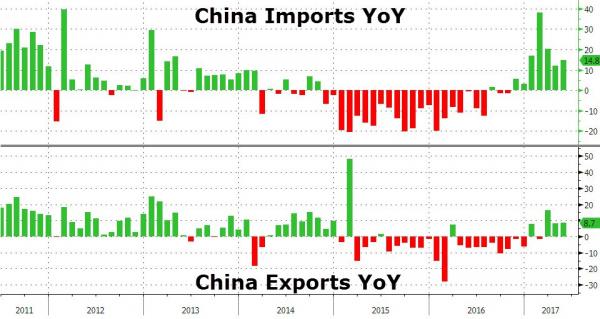

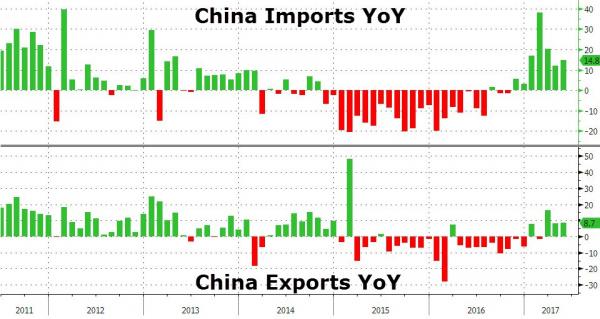

Thanks to a 13% surge in crude imports (as refiners prepare for maintenance season), China’s trade surplus hit its highest since Jan (though -4% YoY). Imports (+14.8% YoY) and Exports (+8.7% YoY) both beat expectations.

China’s overseas shipments accelerated in May from a year earlier, as Bloomberg suggests global demand shows signs of picking up.

Exports rose 8.7 percent in May in dollar terms, the customs administration said Thursday. Imports increased 14.8 percent, leaving a trade surplus of $40.81 billion dollars. (In yuan terms, exports rose 15.5 percent and imports surged 22.1 percent, bringing the trade balance to 281.6 billion yuan.)

A brighter international outlook may provide support to the world’s largest trading nation, with the World Trade Organization saying it expects trade to “expand moderately” in the second quarter.

Still, after a robust start to the year, the domestic economy is displaying some signs of weakening momentum. The official factory gauge held up in May, but a private gauge signaled contraction for the first time in 11 months.

China and the U.S. announced a deal in May to promote Chinese access for U.S. natural gas, financial services and beef as an “early harvest” of a 100-day review of the bilateral trade relationship that’s due to wrap up in July. China also vowed it will import $2 trillion from neighbors participating in its Belt and Road Initiative in the coming five years.

China’s crude imports increased as refiners snatched up cargoes to prepare for the end of seasonal maintenance.

Buying by China, which Bloomberg notes has overtaken the U.S. this year as the world’s biggest importer, averaged about 8.8 million barrels a day in May, up 4.8 percent from the previous month, according to Bloomberg calculations using General Administration of Customs data released Thursday. Net exports of oil products jumped 50 percent from April to 1.51 million tons.

Leave A Comment