The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the 28-day).

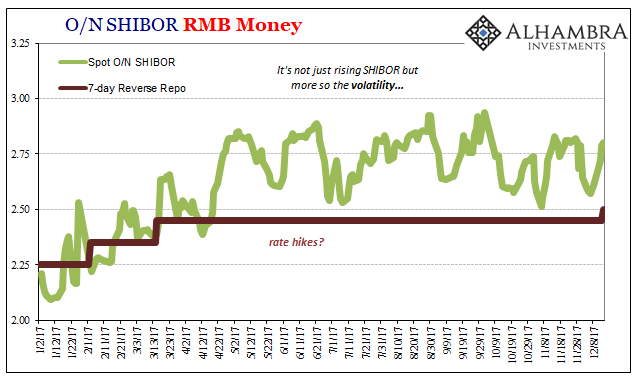

These are being characterized as always as rate hikes when in fact they are at most window dressing. The moves are the third time so far this year the PBOC has acted, and they haven’t in total really changed the policy rates all that much. The 7-day reverse repo rate is up a total of 25 bps in 2017, whereas O/N SHIBOR, a measure of private RMB costs, has moved by a lot more. The policy rate rather than pushing the private money rate is instead following it.

It is mere symbolism, which from the Western perspective might seem a bit silly in a “why bother” kind of way, but on that side of the Pacific it is viewed officially as worth the charade so little margin is left in China. For one, PBOC officials know all-too-well that the media will characterize Chinese monetary policy as shifting to, or going further toward, “tightening.” As with both prior “hikes”, the mainstream has dutifully done just that.

The timing of the second and third coincide with Fed “rate hikes” which gives the real target for the symbolic gestures. China’s central bank aims not on tightening RMB money markets but to ensure a stable CNY. Economists believe that speculators in particular will seek arbitrage in currency exchanges through interest rate differentials, both real and perceived. Therefore, by getting the media to claim the Chinese are tightening policymakers clearly think it will offset any rate bias the Fed might have made with its 25 bps “rate hike” yesterday.

The currency policy has become paramount because stable CNY is China’s only hope. The Chinese economy is described in any number of extremely positive ways by the compliant, uncritical mainstream East and West; the PBOC’s “tightening” seemingly in line with that.

Leave A Comment