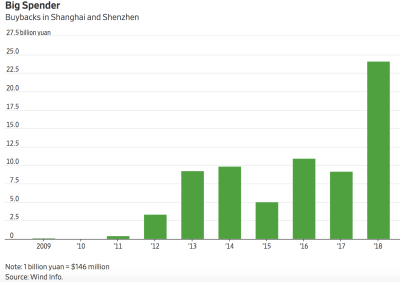

Rivets are starting to blow once more on the debt-on-debt Ponzi driving Chinese markets. Following the lead of western companies, corporate buybacks in China have surged in 2018 (see below). This is the latest desperate effort to stop asset bubbles from following their natural destiny to implosion.

See the WSJ’s Record Buybacks Don’t Mean Buy in China. Chinese companies are spending record amount on buybacks. This is not a sign of confidence:

One reason some Chinese companies are doing buybacks is because Beijing has been encouraging them to do so in the hopes of boosting the Shanghai Composite Index, which has slumped 25% since its January peak. The country’s stock-market regulator last week proposed rule changes to make it easier for companies to repurchase their shares.

Another factor behind the surge in buybacks relates to the sheer amount of stocks used as collateral for loans in China. Major shareholders of Chinese companies have collectively pledged some $700 billion of stocks in return for loans, according to Wind Information. With many small companies’ shares having fallen 30% or more this year, a further drop could trigger margin calls on those loans—hence the need for buybacks to support stock prices. Around a third of the companies that have bought back shares this year have more than 30% of their stock used as collateral for loans.

It’s ironic that The Wall Street Journal article points out buybacks are not a sign of confidence in China, because they aren’t in America either. In both places, buybacks at record valuations are a sign of too much debt-manufactured liquidity with too few legitimate investment opportunities in a slow-growth economy–short-term gimmicks to buy longer-term capital losses.

Leave A Comment