Chinese demand for physical gold investment surged in the first three-quarters of 2017 while Americans ditched the shiny yellow metal for increased bets in the crypto mania and stock market bubble market. Even though China’s Hang Seng Stock Market outperformed the Dow Jones Index last year, Chinese citizens purchased the most gold bar and coin products Q1-Q3 2017 since the same period in 2013, when they took advantage of huge gold market price selloff.

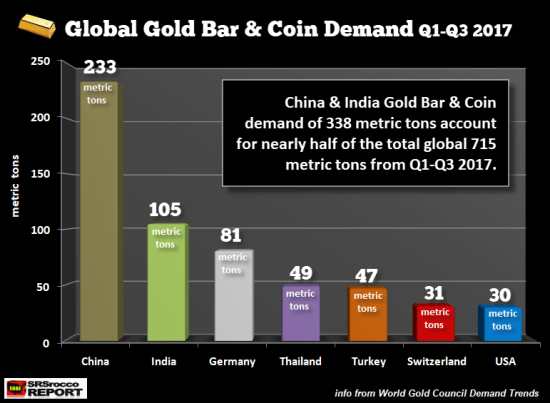

According to the World Gold Council, Chinese gold bar and coin demand increased to 233 metric tons (mt) in the first three-quarters of 2017 compared to 162 mt in the same period last year. Furthermore, if we include Indian gold bar and coin demand, China and India consumed nearly half of the world’s total:

As we can see, China and India consumed 338 mt of gold bar and coin products which accounted for 47% of the total 715 mt Q1-Q3 2017. German gold bar and coin demand of 81 mt took the third highest spot followed by Thailand (49 mt), Turkey (47 mt), Switzerland (31 mt) and the United States (30 mt). Chinese gold bar and coin demand of 233 mt nearly equaled the total demand by German, Thailand, Turkey, Switzerland and the United States of 238 mt.

If we compare gold bar and coin demand by these countries in the same period last year, we can see some interesting changes:

While the increase in Chinese gold bar and coin demand was the big winner (162 mt to 233 mt), Turkish demand nearly doubled from 24 mt in 2016 to 47 mt this year. However, the biggest loser in the group was in the United States. U.S. Gold bar and coin demand fell substantially to 30 mt Q1-Q3 2017 from 66 mt during the same period last year.

As I mentioned at the beginning of the article, Americans shunned gold to make it RICH in the rapidly rising Stock and Crypto Markets. We can see this quite clearly as investors choose to bet on the Dow Jones Index as it surged by 30% last year versus a mere 13.5% for gold:

Leave A Comment