Why would any central bank try to disguise the fact that it is being highly accommodative in its own money markets? That would be a strange place to start, made all the more so by the further observation the same central bank is perfectly happy if you thought it was doing the opposite. Cryptic introduction aside, it is obvious I mean China and the media’s ongoing description of the PBOC tightening.

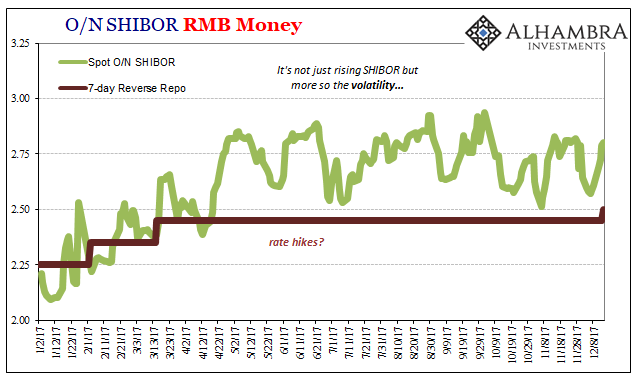

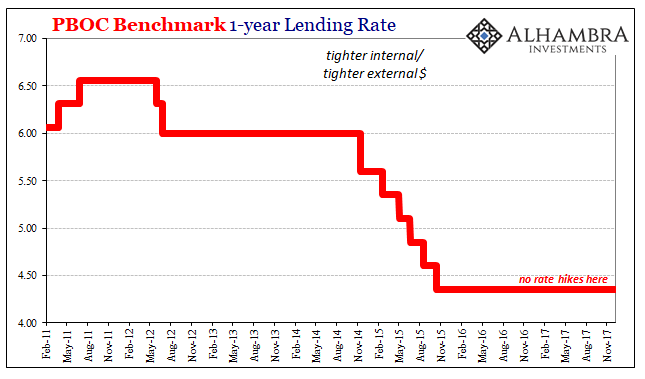

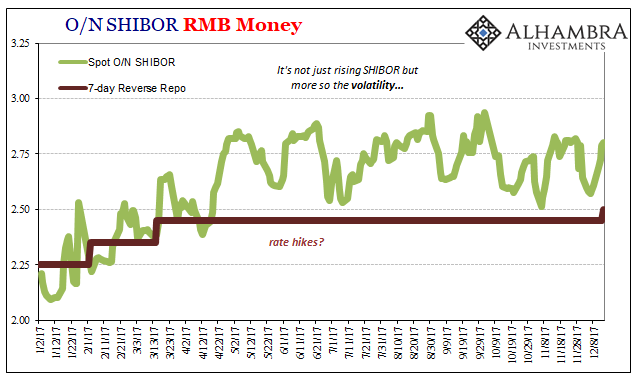

It all starts with the reverse repo rates. From these (there are several, only the 7-day reverse repo is depicted above) we are told that China’s central bank has sprung to action in order to stifle monetary exuberance. Why they haven’t raised their benchmark rates or the RRR is a question never pondered.

That’s because this narrative starts, as always, with the certainty that China’s economy is on the cusp of massive growth; or, at least in the context of the past few years, some actual growth. Therefore, even the slightest change in something is immediately seized upon as evidence that central bankers think the same way. Since policymakers are given high space in the mainstream economic hierarchy, voila, the supposition is proven sufficiently for media publication.

One thing to notice is that SHIBOR rates lead reverse repo rates – by design. The latter are open market operations meant solely to “clean up” whatever happens in the private RMB markets. You could in theory “raise rates” using reverse repos, but why would you ever want to?

And that’s not what’s happening in RMB anyway, at least not more recently. A great deal of what ends up in interbank money markets flows through China’s largest banks. That’s always been the case, a lot more so the past few years of the “rising dollar” as overall bank reserve growth has become very scarce (as a result of “dollar” tightening on the PBOC’s asset side).

Leave A Comment