Despite a liquidity injection and the rest of the world in ‘risk-on’ mode over the French election results, Chinese markets are tumbling…

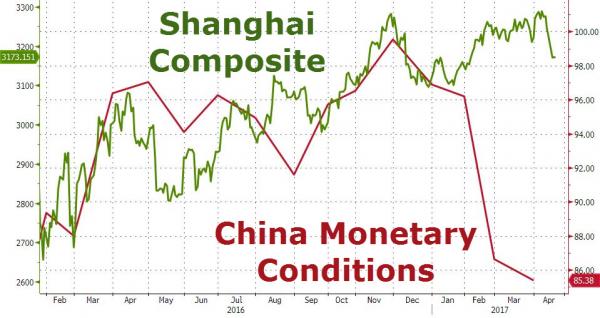

On Friday, we asked “Is China Trying To (Slowly) Burst Another Stock Market Bubble?” as Chinese monetray conditions were tightening dramatically…

And, as Bloomberg reports, it seems the catalyst is further crackdowns on shadow-banking.

China’s banking regulator, which said late Friday it will focus on guarding against financial risks, has ordered local units to assess cross-guaranteed loans, according to a Caixin report.

Having gone 86 trading days without a loss of more than 1% on a closing basis, the longest stretch since the market’s infancy in 1992…

It seems they might be… (or The National Team is going to have to work very hard today)…

As Shanghai Composite breaks below ist 200-day moving-average withe the biggest intraday drop since Dec 12th…

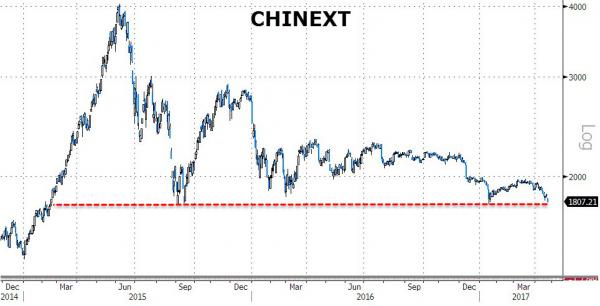

CHINEXT (China’s Nasdaq) is also getting hammered – testing its lowest levels since February 2015….

Leave A Comment