As largely expected, following Friday’s unexpected rate cut by the PBOC (which may have been mostly driven by 5th CCP Plenum considerations), and today’s drop in the onshore Yuan which traded down 0.13% vs the Dollar to 6.3554, China’s stocks opened solidly in the green, led by construction names, with recently troubled Vanke shares jumping 7.4% in early trading, the most since July 10, to their highest level since Aug. 11. Peers such as Longfor, CR Land and China Overseas Land, also jumped by 6.9%, 1.9% and 1.4%, respectively.

China’s indices were solidly green in early trading, with the Shanghai Composite +0.9%, Shenzhen Comp +0.8%, and CSI 300 +1.3%.

Hong Kong was likewise euphoric, with several key names standing out:

Elsewhere in the Asian region, early sentiment was also a broad, if somewhat tame, bullishness.

As for China’s key index, the Shanghai Composite, it is up over 1%, or 40 points in early trading, to 3,450 – the highest level in 2 months, a gain which however is well below Friday’s pre-rate cut gain…

… and if prior rate cut history is any indication, not to mention the weak reaction by commodities on Friday (continuing into today, where WTI turned green by the smallest of margins just seconds ago…

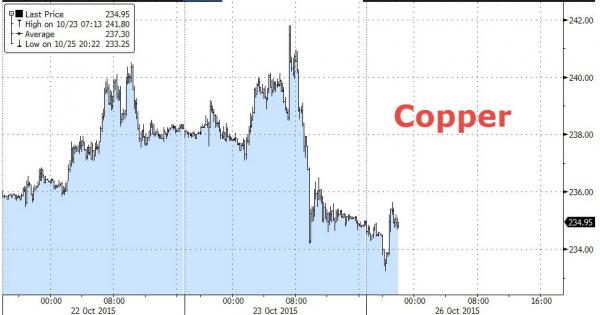

… not to mention copper which is down for the second day in a row…

… we would not be surprised to see China’s stocks sliding back into the red very shortly as “sell the news” concerns return, and as the increasingly more addicted “markets” demand even more liquidity from central banks just to stay unchanged, let alone rise to new all time highs.

Average:

Leave A Comment