Almost 800 points off the lows on the heels of Larry Kudlow’s comments after China escalates the global trade war? The stench of The PPT was rife today…

Video length: 00:00:06

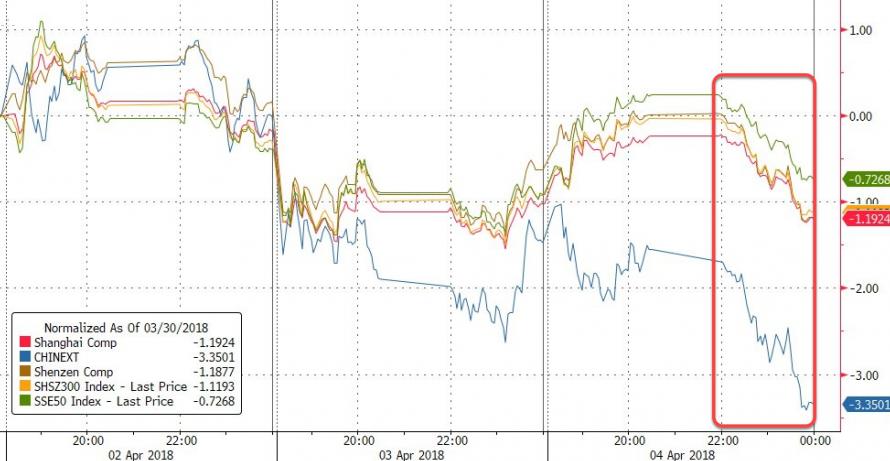

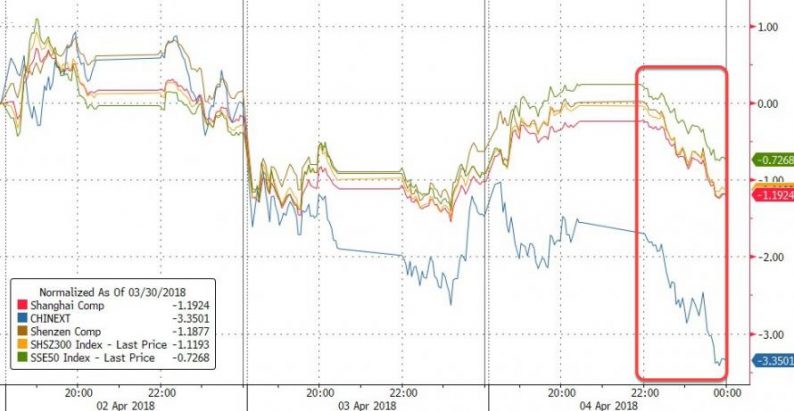

Chinese stocks went out weak after the trade tariff headlines…

And US equity futures were monkeyhammered overnight and through the open. But some sickly-sweet words from Larry Kudlow was enough ignite some momentum and rap stocks all the way back to green… and back to the opening ledge on Monday… and then to last Thursday’s highs…

For some context, that is almost a 1000-point bounce in The Dow…

The cash markets all tracked each other perfectly…

S&P 500 EXTENDS GAIN ABOVE FRIDAY’S CLOSE, UP AS MUCH AS 1.15%

Seeing favorable market response, Trump next raises China tariffs to $100BN

— zerohedge (@zerohedge) April 4, 2018

All on one big mega short squeeze…

S&P bounced back above its 200DMA…

Nasdaq futures perfectly bounced off their 200DMA…

VIX crashed back below 20…

FANGMAN stocks were panic-bid – MSFT and AAPL green on week…

There was one stock that did not benefit from the panic dip buyers…

Bank stocks ripped into the green for the week…

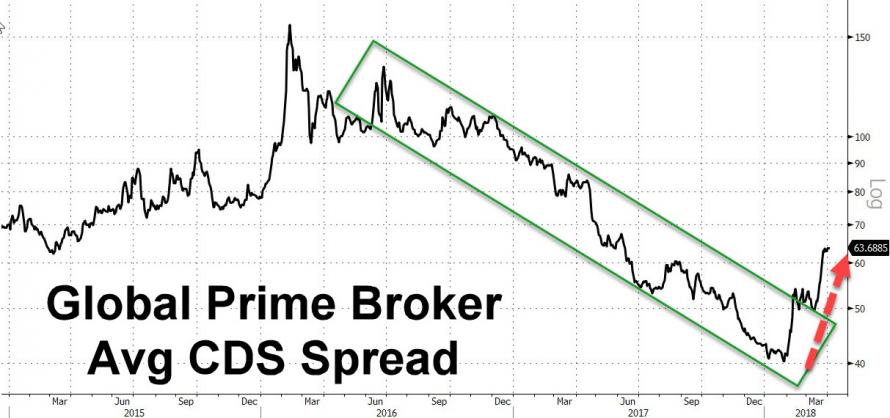

But bank credit risk continues to break out…

More disappointing macro data today and stocks have finally caught down to that reality…

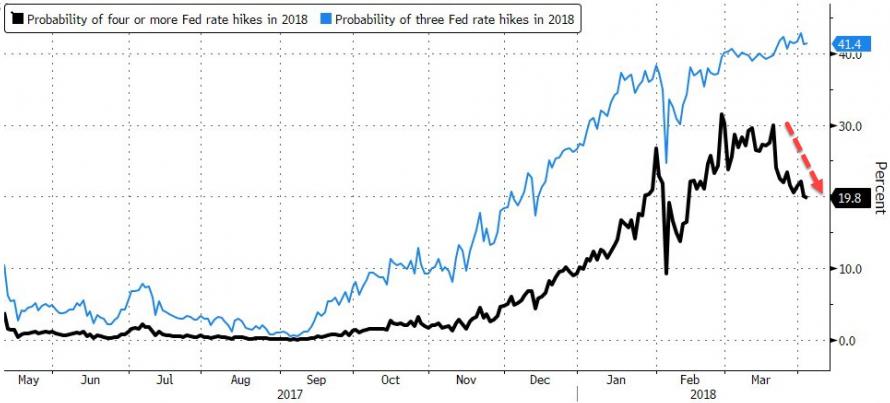

And the probability of a 4th rate hike in 2018 (so 3 more) has tumbled to less than 20%…

Treasury yields rose on the day and are higher on the week…

Leave A Comment