Chubb (CB) is one of the best managed insurance companies in the world and has increased its dividend for more than 20 consecutive years.

Prior to the 2016 merger of Chubb and ACE (the largest merger ever in the history of the insurance industry), these companies had raised their dividends for 33 and 22 consecutive years, respectively.

Chubb was even a member of the dividend aristocrats list.

The insurance business can be a lucrative one, which is why Warren Buffett’s Berkshire Hathaway owns several of these businesses, including a couple in Buffett’s dividend portfolio here.

Let’s take a closer look at Chubb to see if its future remains bright and if today could be a reasonable time to give the stock consideration in a dividend growth portfolio.

Business Overview

ACE announced it was acquiring Chubb for $28.3 billion in July 2015 and closed the acquisition in January 2016, adopting the Chubb name globally. This deal created the sixth-largest U.S. property / casualty (P&C) insurer by premiums. ACE also relaunched the new Chubb brand in January last year.

The merger brought together two conservative insurers with highly complementary business lines – ACE is more international and focused on large commercial accounts, while Chubb is stronger with middle-market companies and personal lines businesses.

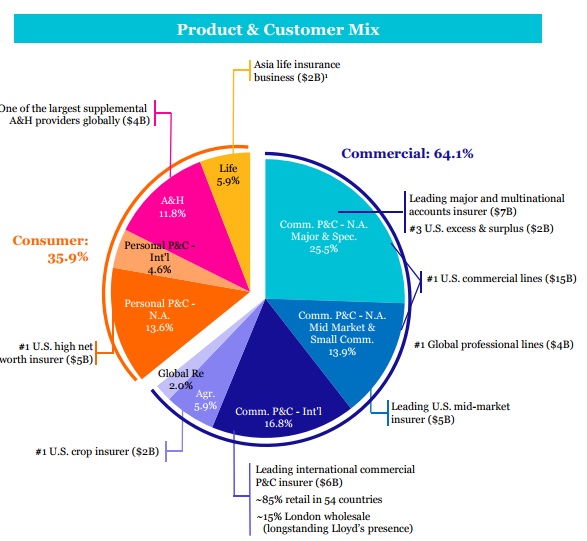

The new Chubb provides commercial and personal property & casualty insurance, personal accident & supplemental health insurance (A&H), reinsurance and life insurance to a wide range of clients. The company writes gross premiums of approximately $35 billion.

As a result of the acquisition, Chubb implemented major organizational changes resulting in new business segments: North America Commercial P&C Insurance (43% of 2016 premiums), North America Personal P&C Insurance (15%), North America Agricultural Insurance (5%), Overseas General Insurance (28%), Life Insurance (7%) and Global Reinsurance (2%).

By product line, Chubb generates 56% of its premiums from commercial P&C, 18% from personal lines, 18% from global accident & health and life, 6% from agriculture, and 2% from global reinsurance.

Source; Chubb Investor Presentation

By geography, the company writes approximately 62% of its net premiums in the U.S., 14% in Europe, 12% in Asia, 7% in Latin America, and 5% in Bermuda and Canada.

Insurance companies make money by writing premiums and investing the proceeds for income before costs and claims need to be paid out. As long as they manage risk appropriately, this type of business model prints money.

Business Analysis

The new Chubb has several competitive advantages, beginning with the size of the business. Insurance policies generally have little differentiation, which makes price an important selling factor.

With the combined company’s massive base of premiums, Chubb can spread its operating costs over wider pool of customers to lower its policy costs, diversify its risks, and offer customers packaged policies that cover a number of types of insurance (Chubb now has one of the largest product portfolios in the global insurance industry).

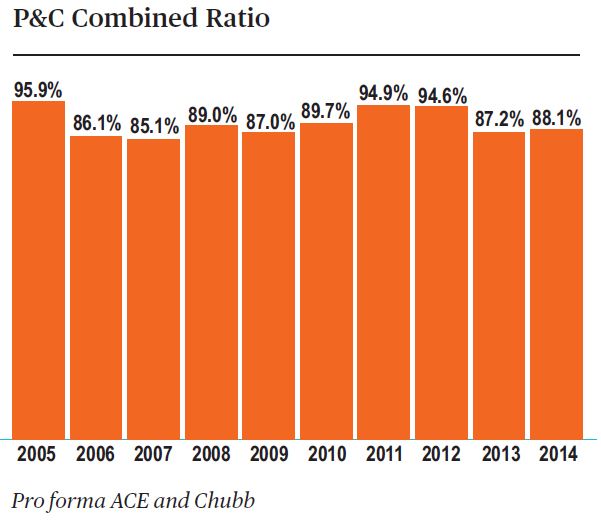

Both of these companies have done an excellent job underwriting conservative policies. From 2010-2014, ACE and Chubb’s average combined ratio was 90%, and it never ran at a loss (see below).

The combined ratio measures an insurer’s costs and claims as a percentage of the total premiums it has written. A ratio below 100% means that the insurance company is generating a profit from its policies and has been smart (or consistently lucky) about the risks it is willing to write policies for.

Source: Chubb Limited

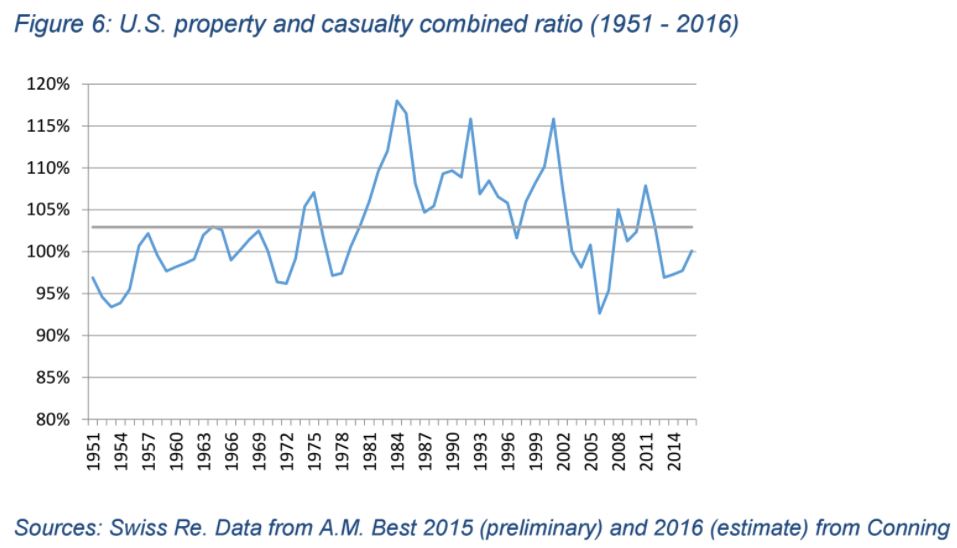

To put this in perspective, consider that the average combined ratio of the U.S. property and casualty industry was 102.8% from 1951 through 2014. In other words, the typical insurer’s underwriting is often unprofitable, forcing them to depend on positive investment results to turn an overall profit.

Source: IAIS Global Insurance Market Report

Leave A Comment