Cisco (CSCO) is a rather unusual dividend stock because it offers a relatively high yield near 4% but has grown its payout at a fast clip, including a 12% boost earlier this year.

In fact, the company’s quarterly dividend payment has increased from 6 cents per share in 2011 to 29 cents most recently, nearly quintupling over the course of six years.

With Cisco’s stock trading off on the company’s latest earnings report and sporting at a relatively low forward P/E ratio of 14.3, let’s take a closer look to see if this company is appealing for conservative investors living off dividends or if it could be a value trap.

If you are interested in Cisco because of its yield, you might also consider reviewing some of the best high dividend stocks here.

Let’s review Cisco’s business.

Business Overview

Cisco was founded in 1984 and has grown to become one of the most important technology companies in the world.

While the business sells a wide variety of products (74% of FY17 sales) and services (26%) to businesses of all sizes, its main offerings connect computing devices to networks or computer networks with each other.

The company’s website provides an overview of switches (29% of sales) and routers (16%), which are Cisco’s largest product segments.

Switches are used in buildings, campuses, offices, and data centers to connect devices such as workstations, servers, and phones together on a computer network. They help receive and forward data to the right device.

Routers pass along data packets between computer networks to connect wireline and mobile networks used for mobile, data, voice, and video applications. They essentially direct the internet’s traffic to the appropriate destination.

The rest of Cisco’s product revenue is spread among a number of faster-growing segments – Collaboration (9%), Data Center (7%), Wireless (6%), Security (4%), and Service Provider Video (2%). Most of Cisco’s products and services are sold through channel partners such as telecom providers and systems integrators.

The company’s service revenue consists of technical support, subscriptions, and software that are spread across its various segments.

By geography, approximately 59% of Cisco’s sales last fiscal year were in the Americas with another 25% in EMEA (Europe, the Middle East, and Africa) and 16% in Asia.

Business Analysis

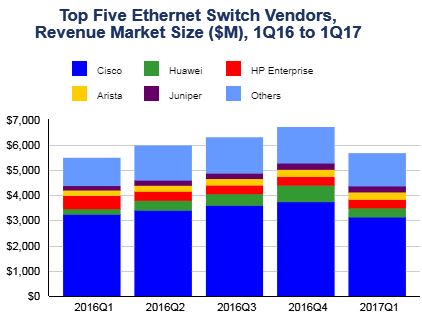

Cisco dominates most of its core markets. According to IDC, Cisco’s share in the Ethernet switching market was 55.1% at the end of the first quarter of 2017. The company’s market share in routers and services stood at 43.9%.

As seen below, no other vendor comes close to Cisco’s dominance in these markets, even despite some of the market share losses Cisco has experienced in recent years.

Source: IDC

Why has Cisco been able to dominate these markets?

Cisco’s advantage starts with its ability to offer customers an entire suite of solutions with its network equipment and services.

The company has evolved from selling networking hardware into selling higher-value packages of complete architectures and solutions that improve customers’ businesses.

Selling architectural solutions is much more profitable for Cisco and allows the customer to deal with fewer vendors and potentially enjoy a lower total cost of ownership.

Most of Cisco’s competitors do not have the same breadth of products and services (e.g. security, switching, wireless, routing, collaboration), making them less of a factor in these lucrative deals.

Cisco has spent more than $18 billion on research and development over the last three years combined to stay relevant and build out its portfolio, a magnitude of spending that few companies can come close to matching.

Cisco also has about $2 billion in venture capital investments spread across more than 100 companies that help it gain forward-looking insights into the changes its markets are going through.

To continuously round out its portfolio to meet the market’s evolving needs, Cisco has spent more than $80 billion since 1995 to acquire over 250 companies and has also partnered with major technology players such as EMC, VMware, Ericsson, Apple, and Microsoft.

A recent example is Cisco’s $1.4 billion acquisition of Jasper Technologies in 2016 to become the largest cloud-based Internet of Things service platform provider. In analytics, the company has used its financial muscle to become a leading player by acquiring cloud and analytics company AppDynamics for $3.7 billion in 2017.

These deals are part of Cisco’s multi-year transition as it shifts its model from a primarily hardware business into more of a software and services business, which has been a top priority for CEO Chuck Robbin since he took the helm in July 2015.

While Cisco has a long ways to go, its investments in recurring software and subscription businesses have started bearing some fruit.

About 31% of Cisco’s revenue is recurring, and revenue from subscriptions represent over 50% of its software revenue. The company also registered 50% year-over-year growth in its deferred product revenue related to software and subscription businesses last quarter.

The diagram below shows Cisco’s increasing share of software and service revenue from its newer generation of enterprise switching products, for example.

Source: Cisco Presentation

Cisco announced a new security service in June to help improve sales of its switches, which have stagnated in recent years.

In fact, Cisco’s annual switching hardware revenue has remained about flat from 2010 through 2016 while the market for switching hardware has risen about 16% to $24.4 billion.

Incorporating more software and services directly into its core hardware products is necessary to protect market share and support profitable growth.

Another example was Cisco’s recent acquisition of Springpath for $320 million in August 2017.

Springpath provides so-called hyperconverged systems, software which essentially combines data storage and computing to help companies save costs by reducing the amount of hardware needed to operate data centers.

Leave A Comment