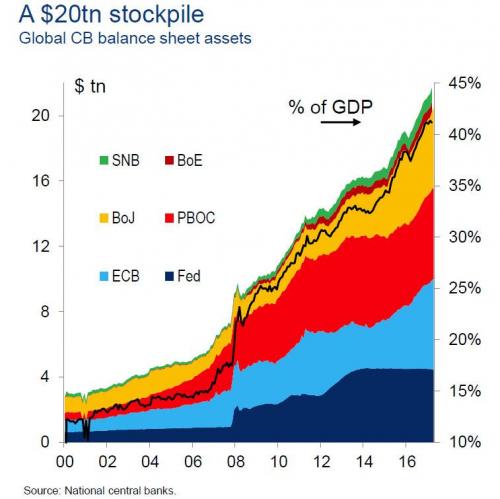

Earlier today, we showed that on the 9th anniversary of the so-called “bull market”, central bank balance sheet accounted for over 40% of global GDP, amounting to no less than $21 trillion. That in itself, should explain why the “most hated bull market” of all time is not a bull market at all, but the world’s biggest experiment in central planning.

Yet the time of this unprecedented monetary experiment is coming to an end as we are finally nearing the point where due to a growing shortage of eligible collateral, the central bank support wheels will soon come off (the ECB and BOJ are still buying massive amounts of bonds and equities each month), resulting in gravity finally regaining control over the market’s surreal trendline.

It’s not just central banks, however: also add the one nation which 5 years ago we first showed has put the central bank complex to shame with the amount of debt it has injected in the global financial system: China.

Appropriately, this central bank handoff is also the topic of the latest presentation by Matt King, in which the Citi credit strategist once again repeats that “it’s the flow, not the stock that matters”, a point we’ve made since 2012, and underscores it by warning – yet again – that “both the world’s leading marginal buyers are in retreat.” He is referring to central banks and China, the world’s two biggest market manipulators and sources of capital misallocations.

And yet, we all know this, and that’s precisely the problem, one which has served as a persistent source of confusion for one of Citigroup’s brightest minds in the past decade. And, as Matt King puts it in a slide titled announced ? discounted, “We know what central banks are doing, so why are we so slow to price it in” especially since the marginal buyer – central banks – sets the price, and the marginal buyer will be gone by this time next year?

Leave A Comment