“Rumors of my death have been greatly exaggerated”. – Mark Twain

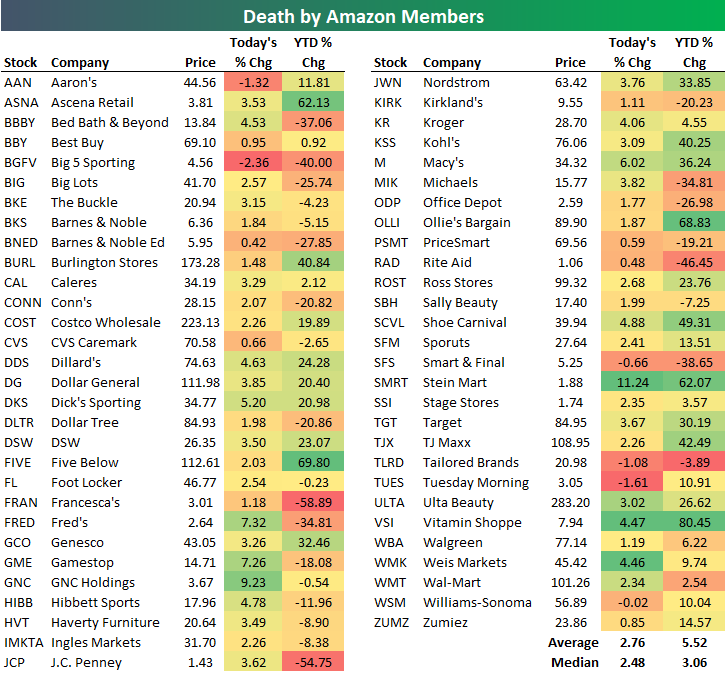

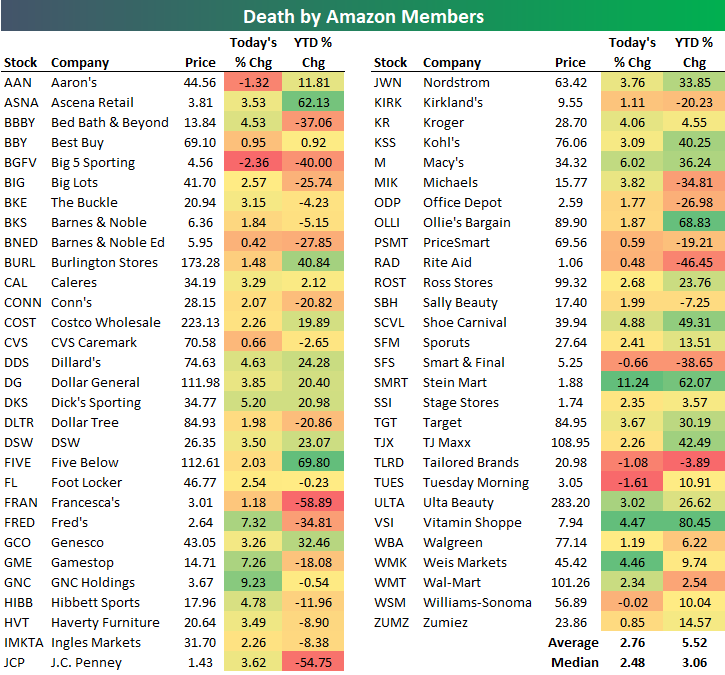

Traditional brick and mortar retailers are soaring today with the average stock in our Death by Amazon index up 2.76% on the day. As shown below, around half of these retailers are up 3-5% on the day with just a handful in the red.

As brick-and-mortar retailers see buying, Amazon.com (AMZN) has seen another wave of selling today with a drop of more than 4.5% as of mid-afternoon. This is on the heels of AMZN’s 7.82% drop on Friday after the company missed revenue estimates and lowered guidance for the second quarter in a row.

The chart for AMZN is really breaking down. After trading in a tight uptrend channel from October 2017 through August 2018, the stock is currently in free-fall in what appears to be a straight path towards $1,500/share.What’s remarkable is that even after the stock’s 23.6% decline from its highs, it’s still up 34% year-to-date!

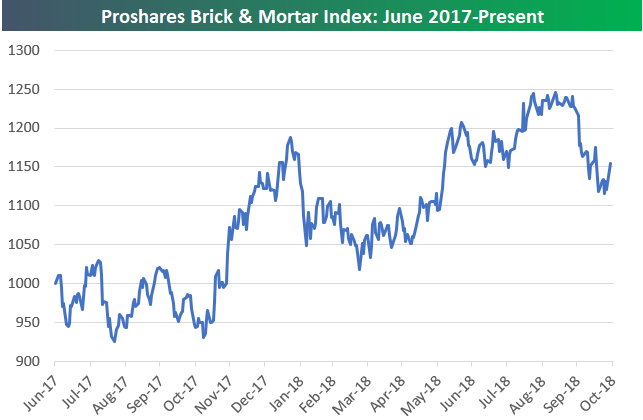

The chart for the Proshares Brick & Mortar index (which was created years after we formed the Death by Amazon index) has fallen a bit from its highs, but it still looks much more constructive than AMZN’s chart at this point, especially with today’s big bounce.

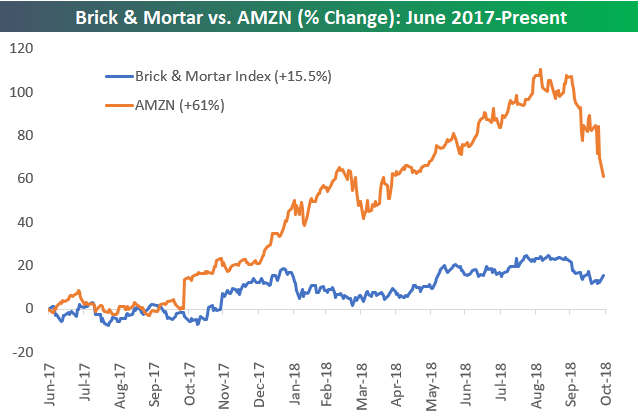

Since the Proshares Brick & Mortar index began back in June 2017, AMZN still holds a commanding lead on it.AMZN is up 61% versus a gain of 15.5% for Brick & Mortar. However, the fact that Brick & Mortar is in the green at all over the last 16 months is the real story. From mid-2015 through mid-2017, traditional retailers most at risk of online were slammed, but they’ve actually been performing quite well recently.

Leave A Comment