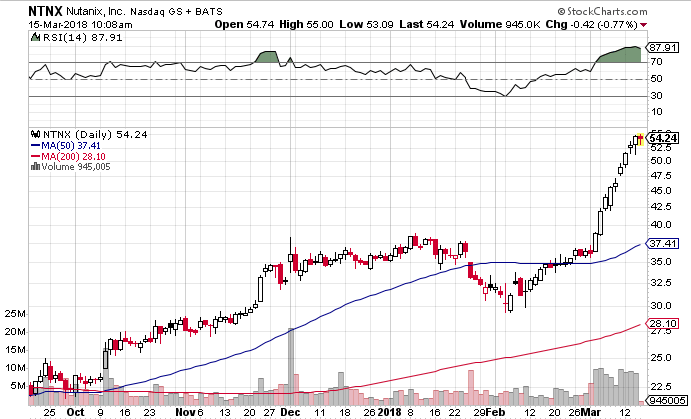

In case you haven’t noticed we’ve seen an acceleration of enterprise cloud adoption. Stocks like Nutanix (NTNX), Twilio (TWLO), MongoDB (MDB) and Okta (OKTA) have all taken off in the past few weeks on the back of improving fundamentals.

The shift is captured in a quote overheard during an industry conversation – “large companies are now moving their core IT to the cloud.” For the last decade there has been plenty of cloud “adoption” but it’s been part of a “hybrid” strategy. Now it’s full-on.

Corporate networks have not evolved fast enough to keep up with cloud adoption. Anyone who has had to use a “corporate VPN” to access their applications outside the office knows how creaky these approaches have become.

Zscaler (ZS) preaches a new approach to network security which is to stop thinking about data center as “castles” and security as “moats” designed to protect assets. They refer to the resulting network topology as “hub and spoke” which is inherently not very cloud-like.

To be fair Zscaler has kind of “snuck up” on this vision as a result of their individual product strategy. One product, ZIA, provides secure access to external applications and another, ZPA, provides secure access to internal applications.

You can review the whole ZS IPO slide deck and our transcript of the ZS IPO roadshow presentation for the full story.

By bringing these two products together Zscaler is able to offer an end-to-end security solution that can bypass some of the intermediary components since – reducing cost and complexity while enhancing scalability and performance.

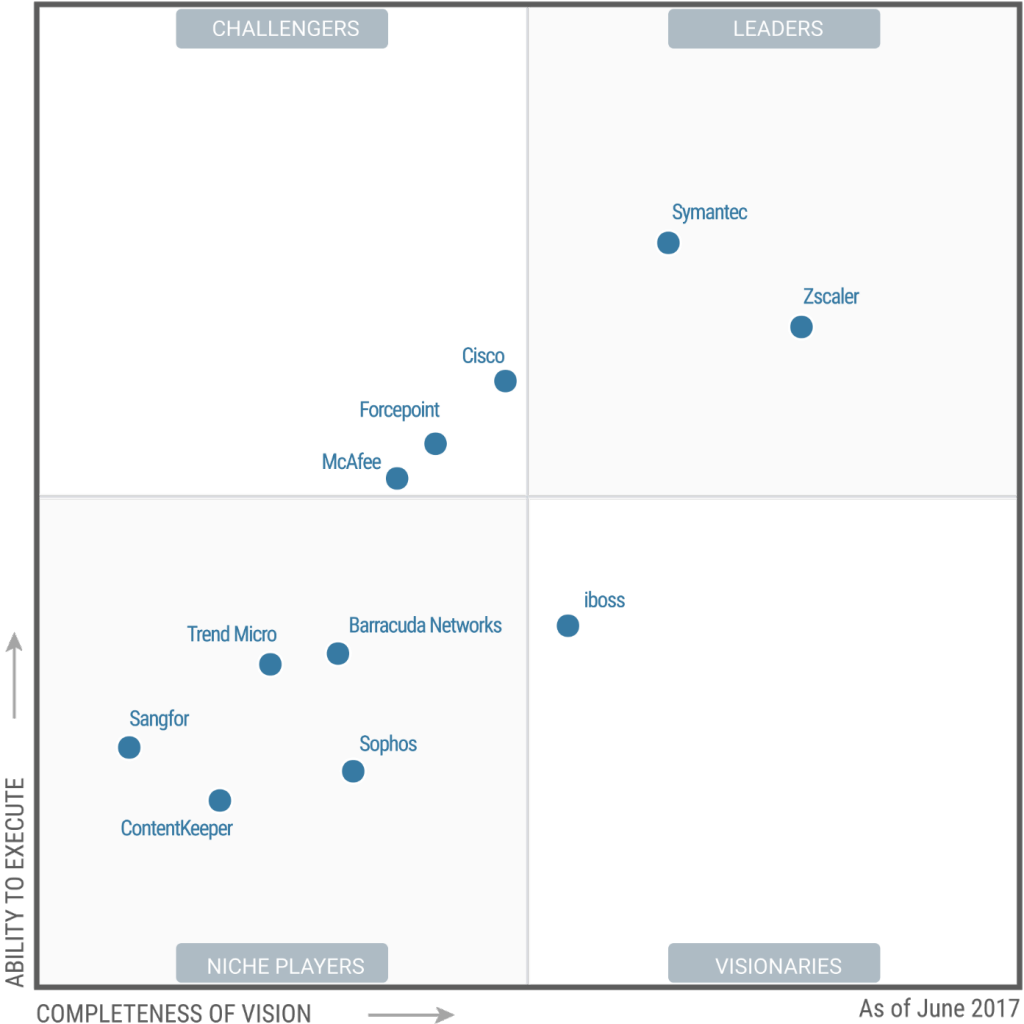

It’s not perfect but they are the leading vendor in this space with a widening lead according to Gartner Group.

Symantec (SYMC) is also positioned in the leaders quadrant thanks to their $4.65B acquisition of Blue Coat in 2016. Given that Zscaler is taking share they will have room to grow their valuation form the proposed $1.3B. (Our IV is below.)

Leave A Comment