The coffee price has risen from its lows and this could well be the start of the expected big rally which has been laid out previously. Let’s review the daily chart and monthly charts.

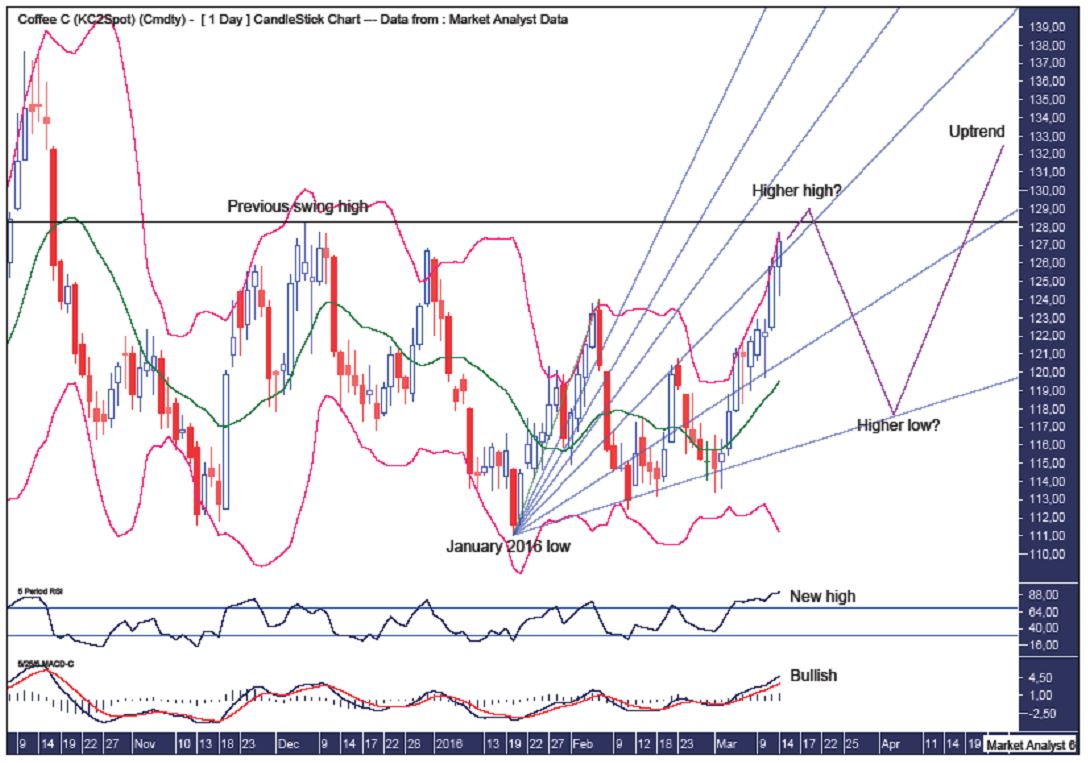

COFFEE DAILY CHART

We can see price has been moving up nicely since the January 2016 low at $112.53. To really gain confidence that a new bull trend is in play the price needs to crack above the previous swing high level which stands at $128.30 and is denoted by the horizontal line.

The Bollinger Bands show a lot of bouncing up and down between the upper and lower bands and price now looks to be surging higher as it hugs the upper band. Once a higher high is in place then I would expect a move back down to the lower band to set up a higher low.

I have drawn a Fibonacci Fan from the low to first high. This shows price finding support back down at the 88.6% angle. Price is now around resistance from the 61.8% angle and the perhaps price will climb up a bit more along this angle or even surge up to the 50% angle before correcting. And perhaps after a new swing high price will once again come back to the 88.6% angle to put in a higher low. Let’s see.

The RSI is overbought so perhaps we are nearing the end of this leg up. Also, this RSI reading has made a new high which is generally bullish in that after a correction it would be normal to expect price to trade back up to new highs while the RSI makes lower highs thereby setting up once or more bearish divergences.

The MACD indicator is bullish and is looking strong by making new highs also.

Let’s now review the bigger picture using the monthly chart.

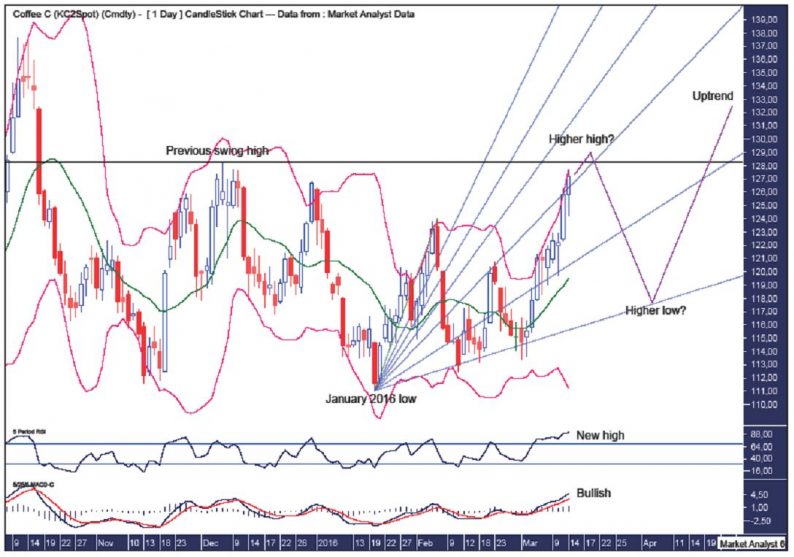

COFFEE MONTHLY CHART

The RSI is showing multiple bullish divergences at the recent low while the MACD indicator has just made a bullish crossover. Nice.

The PSAR indicator is bullish with the dots underneath price.

The Bollinger Bands look to be tightening and price is already back at the middle band. I’d expect some work to be done around this middle band before price sets sail for the upper band and continues higher as it highs that band.

Leave A Comment