Coffee prices have been devastated over the past 5 years, together with much of the overall commodity space, but it appears that a bottom may be in and prices could rise significantly.

Coffee Prices, 5 year:

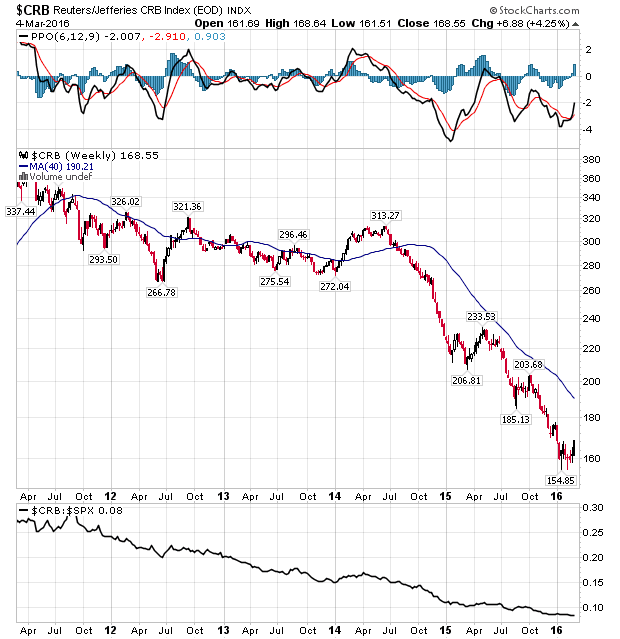

Commodity Prices (CRB Index), 5 year:

While Coffee commodity prices have plunged, companies such as Starbucks (SBUX) and Dunkin Donuts (DNKN) have benefited from the much lower input costs.

Much of the decline in commodity prices has been likely due to a decrease in global demand as well as an overall threat of deflation. Though the threat of deflation, or at least an economic growth slowdown, is very real, the resulting drop in many commodity prices is at this point overdone. The declining prices may be warranted, but after such massive declines a bounce or recovery is needed. This could very well be a long-term bottom in many commodities; but even if it isn’t, a “breather” is needed and prices could see a considerable increase.

Zooming into a 1-year daily chart of Coffee, we can see a long, downward trend-channel:

Coffee prices have been stuck in a downtrend, tightly within a “channel”. In order to break out into an uptrend, prices have to forcefully rise above $130. If Coffee prices “break out” above the $130 upper trendline, they could go much higher.

Relevant stocks: $JO $CAFE $SBUX $DNKN $GMCR

Leave A Comment