It was another very volatile day in the natural gas market, as we saw prices shoot higher overnight on colder model guidance before pulling back through much of the day on profit-taking and impressive supply growth with the November contract settling right around flat.

While the November contract sold off quite a bit on the day, the winter strip was far more firm, with the January contract easily logging the largest gain.

The result was a large move wider in the X/F November/January spread after it narrowed significantly and consistently the last couple of weeks.

The reversal through the day marked another day in the natural gas market with a large trading range relative to what we saw through much of the summer, as the 5-day average trading range has closed in on 12 cents.

Continued cold risks have certainly helped, as the Climate Prediction Center increases them again in the 8-14 Day period.

We maintained our Slightly Bullish sentiment and highlighted that “short-term dips remain buying opportunities” like today’s dip turned out to be.

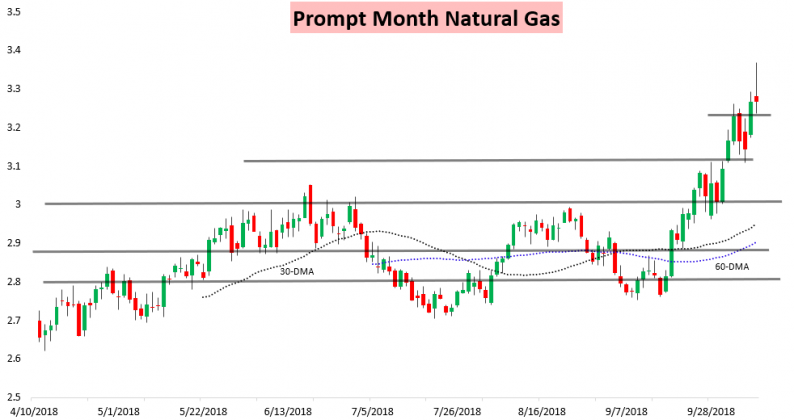

A look at how the front of the natural gas strip had blown out over the past month:

Leave A Comment