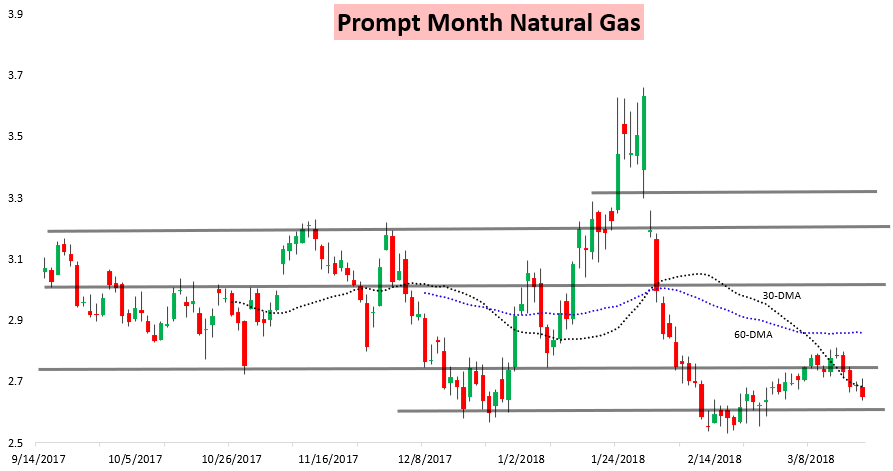

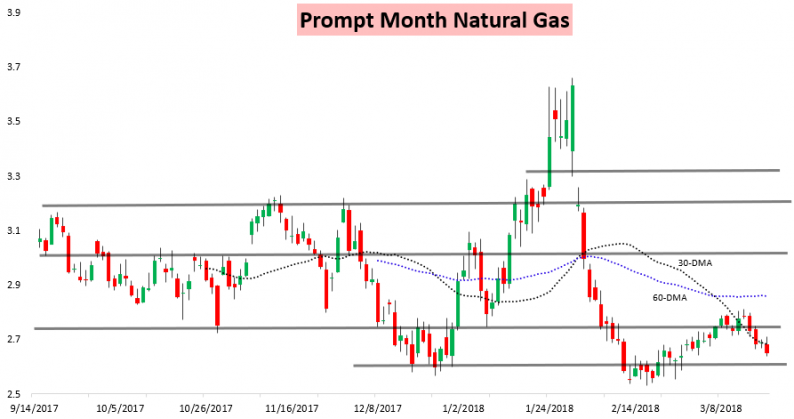

Natural gas traders returned to the weekend with modestly colder forecasts than we ended last week with, though those forecasts were clearly dismissed as prices headed lower through the day Monday.

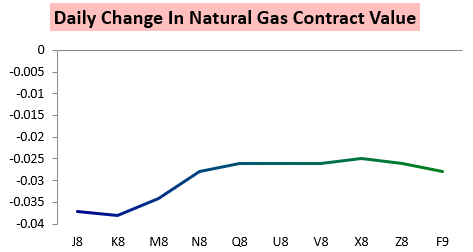

It was not just the April contract but rather the entire strip that sold off, with later contracts recovering weakly into the settle (something we analyzed closely for clients in our Afternoon Update).

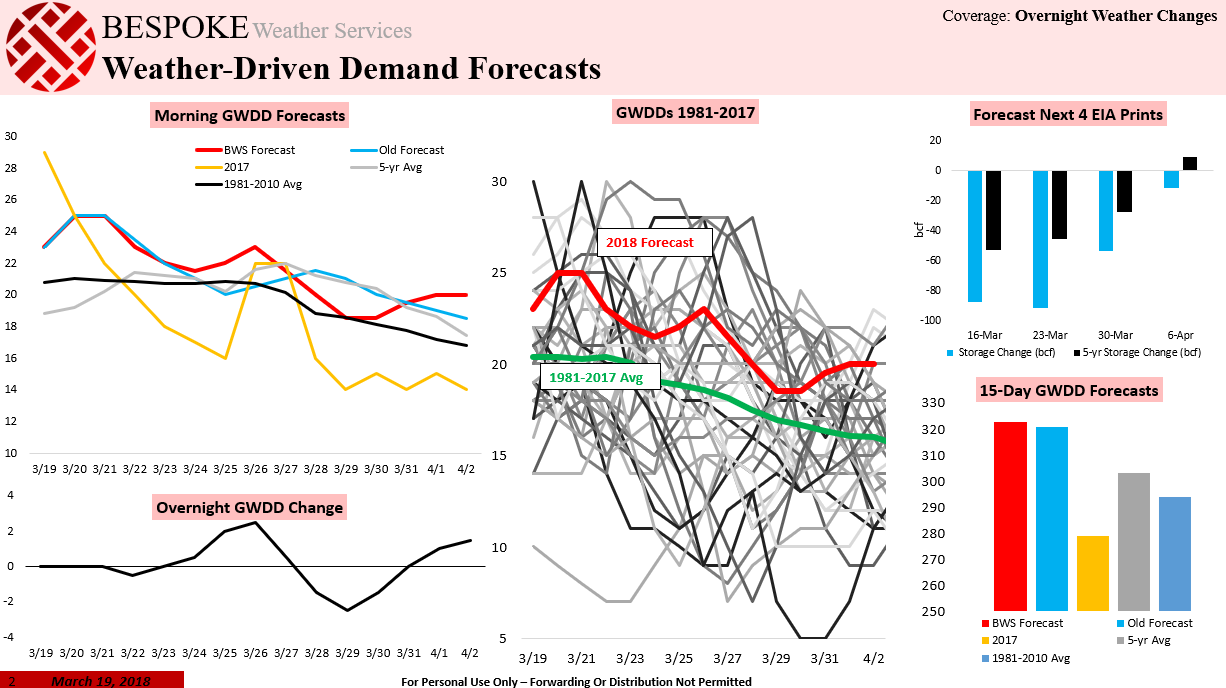

To show some of the colder trends over the weekend, today we unveiled new GWDD charting in our Morning Update to subscribers, as seen below.

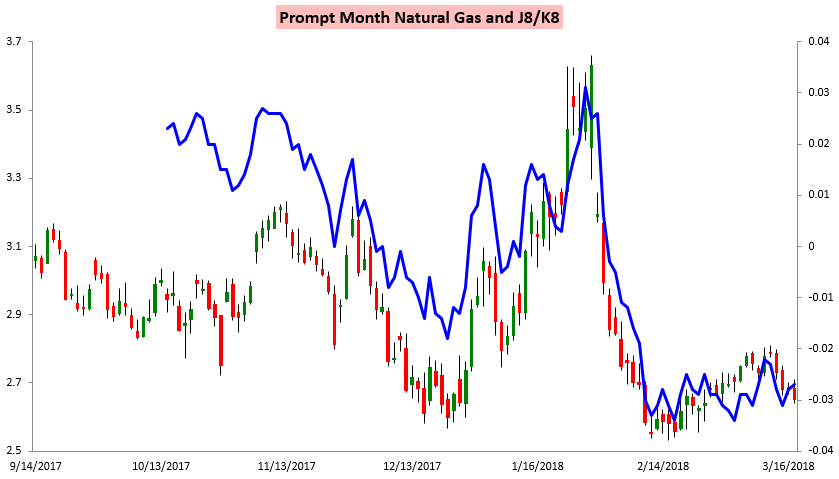

With colder weather we actually did see J/K tick up higher today.

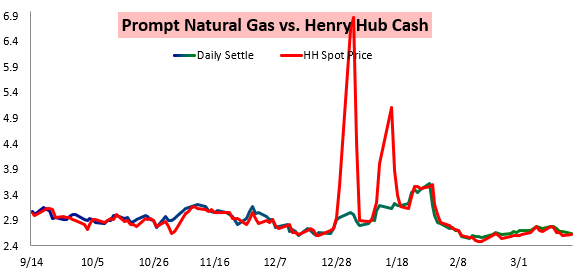

Henry Hub cash prices also ticked slightly higher today.

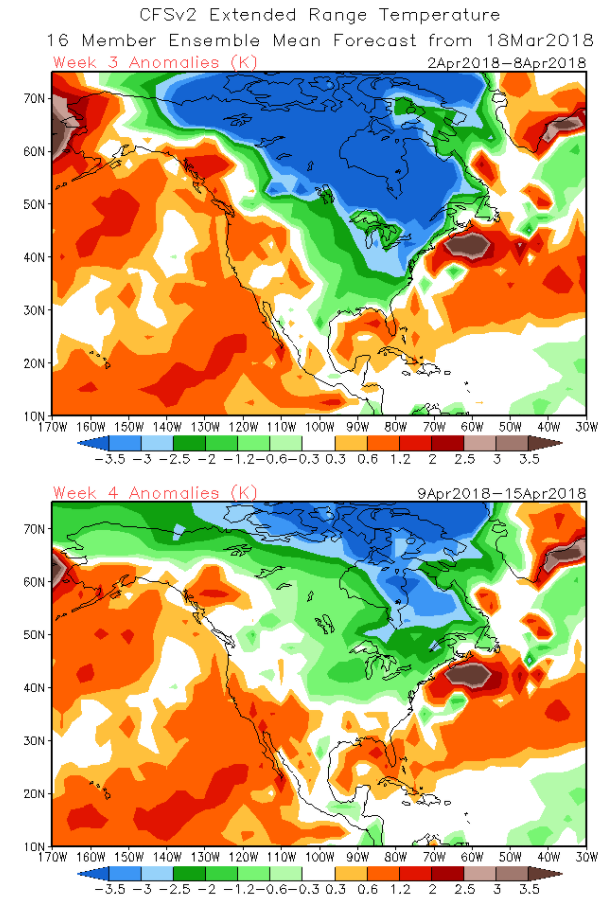

Cold looks unlikely to go anywhere, with CFSv2 weekly climate guidance showing lingering cold risks at least into Week 3 (and potentially beyond), though there is some variability still in long-range guidance that we are sifting through (below image courtesy of NOAA).

Still, as we move into April incremental heating demand changes will mean even less with far less weather variability. As we mentioned last week, our focus in every Update for clients is not just on weather but also on spreads and other fundamentals, weaving all aspects of the natural gas market together to show the relative importance of weather and how it is likely to change. In our Morning Update we forecast that afternoon 12z guidance would continue to confirm morning updates, and sure enough our afternoon GWDD forecast was just .5 above our Morning one, with afternoon European ensemble guidance edging just a tad colder.

Leave A Comment