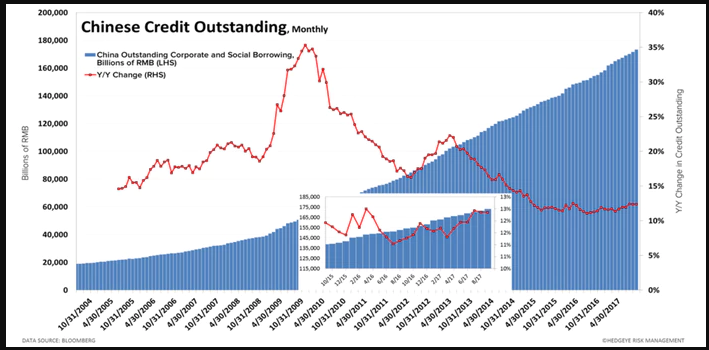

China leads the world in economic growth but that growth is 100% debt-driven. China’s recent $10 trillion in growth comes from $10 trillion in additional debt. In total, China has $26 trillion in debt. Debt is a huge systemic risk, but it’s not just China.

The instability of China’s credit-fueled, investment-focused growth strategy is—without a doubt—one of the greatest systemic risks facing the global economy according to Hedgeye Financials analyst Jonathan Casteleyn.

“The Chinese system has been propped up by debt-fueled growth,” Casteleyn explains in the video above from The Macro Show. “Eventually this very substantial contributor to GDP could start a banking crisis at some point.”

Systemic Risk Not Just China

China is the leader in global growth, and may be among the riskiest in terms of debt, but it’s not just China.

Eurozone Risk

The euro has fundamental flaws and much of the European banking system is insolvent. A quick perusal of Target2 Liabilities shows that as of August (the latest data), Spain owes the creditor countries (primarily Germany) €384.4 billion.

Italy owes it creditors €414.2 billion, and Greece €67.0 billion. Portugal also hit a record this month. It owes its creditors €79.0 billion. The ECB itself owes a record €212.9 billion.

To balance the book, debtors need to pay Germany a collective €852.5 billion, the Netherlands €107.5 billion, and tint Luxembourg €183.5 billion.

USA Risk

US public debt to GDP rose from 62.5% to over 100% in five years. It has since stabilized, but that assumes an 8-year recovery continues for something like forever.

Leave A Comment