The number of US public companies (that is, companies with stock traded on a public exchange and owned by those shareholders) has dropped by half in the last 20 years. Part of the reason is a slowdown in the rate of start-ups; part is a rise in mergers and acquisitions of existing firms. In the next few months, these forces will be playing themselves out in the markets for seeds and agricultural chemicals. James M. MacDonald discusses one arena in which these forces are playing out in “Mergers and Competition in Seed and Agricultural Chemical Markets,” published in Amber Waves from the US Department of Agriculture (April 3, 2017).

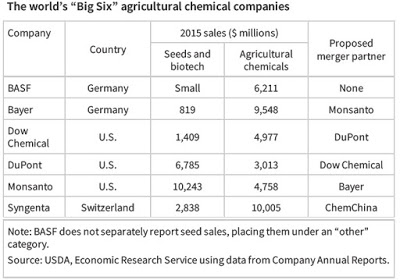

As MacDonald explains, the global economy currently has a “Big Six” of agricultural chemical companies. However, Dow Chemical and DuPont have announced a plan to merge, and Bayer has announced a plan to buy Monsanto, which would reduce the Big Six to the Big Four. At the same time, a state-owned Chinese chemical company called ChemChina has made an offer to buy Syngenta, another one of the Big Six. So here’s the current industry, and the proposed transactions, in a table.

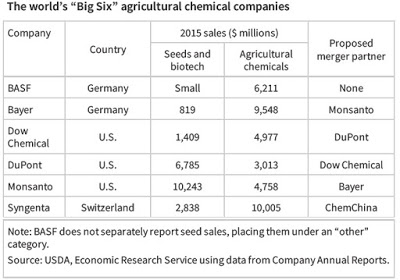

As MacDonald explains, the Big Six itself is a fairly recent development: “The “Big Six” emerged in the 1990s and early 2000s, arising from mergers among large chemical, pharmaceutical, and seed companies as well as from their acquisitions of many smaller seed and biotechnology companies. At the time, the future of integrated life sciences companies promised to use new developments in biotechnology to support work in human pharmaceuticals, seed genetics, and agricultural chemicals. That vision did not reach fruition, as the pharmaceutical businesses later separated from the seed and agricultural chemical businesses.” But now that the Big Six has happened, markets for specific seeds are not surprisingly quite concentrated. For example, here are four-firm concentration ratios (that is, the share of sales by the largest four firms) in US production of corn, cotton, and soybeans, for 2000 and 2015.

Leave A Comment