Conatus Pharmaceuticals (Nasdaq:CNAT) was initiated with Outperform rating and $16 (208% upside) price target at Oppenheimer.

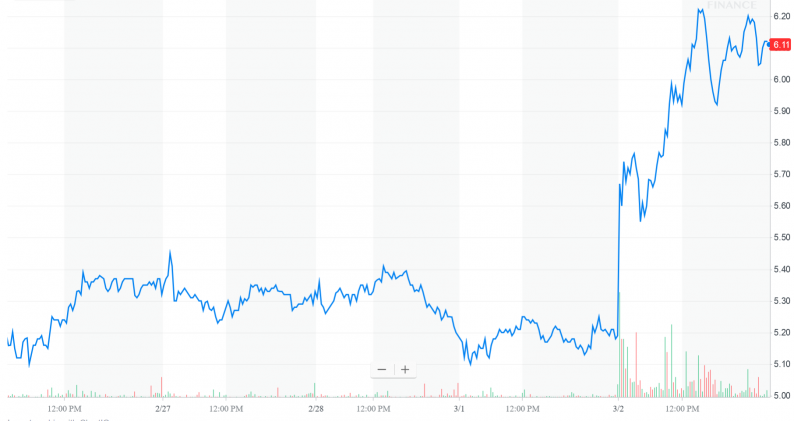

The stock is absolutely flying on this news, but there are other reasons to be bullish beyond today’s action

Conatus’s lead product candidate is emricasan, a first-in-class pan-caspase protease inhibitor designed to reduce the activity of human caspases. NASH has been associated with caspase activation. By reducing the activity of caspase, emricasan can potentially interrupt liver disease progression. And there is some compelling pre-clinical and clinical data to back this. Emricasan has already been studied in sixteen clinical trials and has shown promise. This was the reason Novartis (NVS) entered into a collaboration agreement with Conatus in December 2016.

In May 2017, Novartis exercised its option to an exclusive license for the worldwide development and commercialization of emricasan. Conatus has already received $50 million in upfront payment (December 2016 when it signed the agreement), $15 million in February 2017 in exchange for a convertible promissory note issued to Novartis and $7 million after Novartis exercised option.

While Conatus is bearing the costs for the Phase 2b studies, the company will be reimbursed. In addition, Novartis will assume full responsibility and costs for the Phase 3 stage with emricasan and all combination product development. The Novartis partnership not just validates emricasan’s potential but also de-risks Conatus as an investment.

Emricasan is currently in four separate studies, data from which are expected to be announced over the next 16-18 months. The most anticipated data will be from the ENCORE-LF study (due in the second half of 2019).

More detail can be found here

As of September 30, 2017, Conatus Pharmaceuticals had cash and cash equivalents of $85.2 million. The financials are in good shape. That’s because Novartis has agreed to pay 50% of all the phase 2b clinical trial costs. In addition, any trial that progresses to a phase 3 will have Novartis become 100% responsible for all associated costs. That includes the cost to commercialize emricasan should it eventually be approved by the FDA. Conatus believes that with its current cash on hand it will be able to fund operations until the end of 2019. That should help carry it through the rest of the clinical trial readouts. In addition, Novartis will be responsible for footing the bill for any future trials that arise from the ENCORE clinical program.

All things considered this is a speculative but promising play.

Leave A Comment