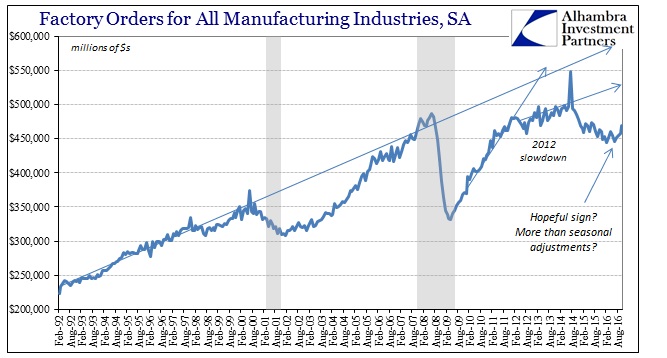

Total factory orders in October 2016 were almost unchanged year-over-year (NSA) from those of October 2015, up just 0.5%. That was the second straight month of no growth, as factory orders in September were down just slightly, -0.1%, after being revised somewhat lower. Combining both September and October together, factory orders in those two months were 0.2% above the same two months in 2015. That would indicate the same weak but not getting weaker economy.

The seasonally-adjusted series, however, has exploded higher. Month-over-month factory orders were up nearly 3% in October, a jump of $12.5 billion. The seasonally-adjusted gain for both September and October was $15.4 billion. That is a drastically different result than the unadjusted series that suggests no growth or rebound.

There are often these kinds of months where the seasonal adjustments lead to a much different interpretation of whatever economic account. Usually those differences are tied to the calendar placement of holidays or the number of weekends in a particular month as different from the number of weekends in the same month the year before. What is going on here is more than number of days adjustments.

It starts with revisions for last month. The unadjusted figures for September were revised down by $881 million, a change that is pretty standard for the past few years. The adjusted number for September, however, was somehow revised higher by $1.4 billion. That would suggest something had changed between the preliminary estimate and its first revision in the pre-calculated seasonal adjustments?

For October, those seasonal adjustments “expect” a large decrease from September. That makes sense given the Christmas holiday, where factories in the US would run “hot” during the summer to build up product and inventory leading up to the holiday shopping season. By October, whatever marginal production was ordered by the retail sector had been produced and shipped, so factories scale back a bit in the change of season to autumn.

Leave A Comment